It’s been six months since I started religiously using the You Need A Budget app. Here is my YNAB review and budget organizing tips I have learned along the way. This post is sponsored by You Need A Budget

What I’ve Learned In 6 Months With YNAB

About 6 months ago, the You Need A Budget (YNAB) team reached out to me to review their budgeting software. I set things up and gave it a month-long test run using their 34-day free trial. You can learn the basics of how the program works and my initial thoughts in my first post here: YNAB Review. I finished the post thinking: “Like it! But not sure if I’ll use it long-term.”

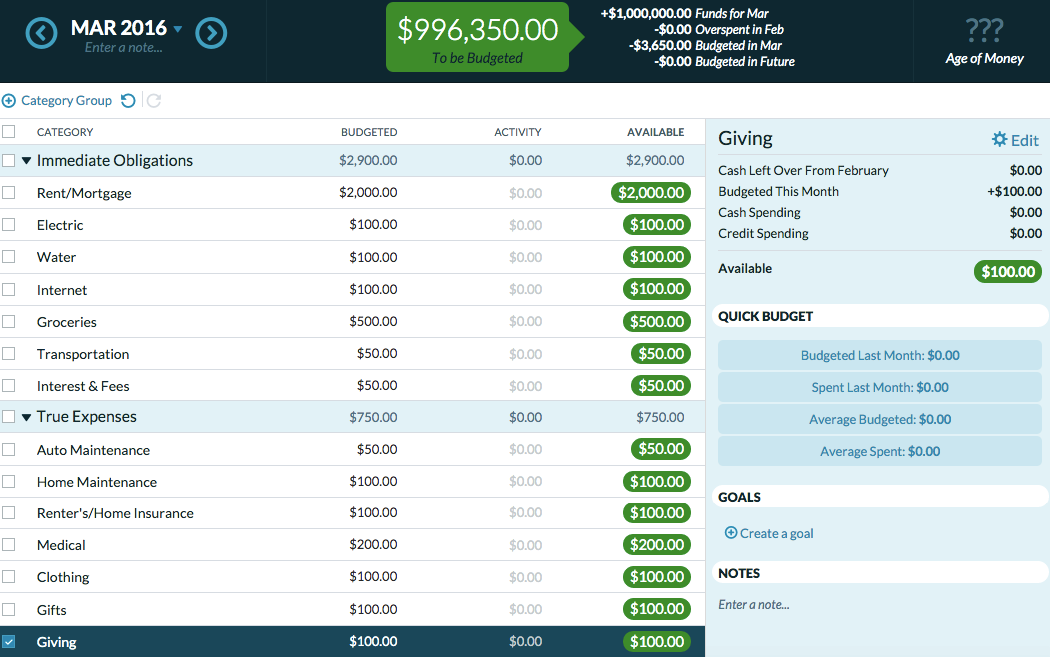

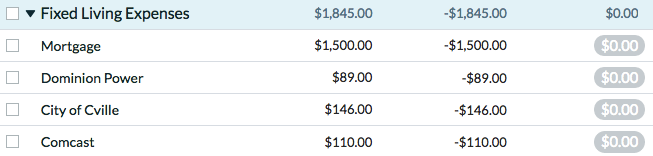

(Please note all examples were created in a fake budget for this post 🙂 )

I am back now to tell you that after using YNAB for half a year, I am OBSESSED! I absolutely love it. When the opportunity to share more of my thoughts in a follow-up post presented itself, I had the post written in my head in five minutes. It’s so easy to write about something that I use everyday and love.

5 Things I’ve Learned Using The YNAB Budgeting App

I have learned why living off last month’s income makes so much sense.

YNAB works best if you let your income accumulate in the “to be budgeted” area throughout the month and then allocate these dollars on the first day of the next month. In the past I just left a significant buffer in my checking account so that there was never a risk of dipping below zero if a bunch of bills autodrafted before I was paid. But as a freelancer, I had to do a lot of predicting when I would get paid.

If you budget on last month’s income, then there are no moving parts. You know how much you get to spend on day one of the month and that’s that. And at the beginning of the month when you get to divide your income between all of the categories is such a fun task. It leaves me feeling quite organized!

Separate Fixed, Variable, And True Expenses

I have my budget broken down into “fixed,” “variable,” and “true” expenses so I can easily calculate what percentage each category plays in my spending. YNAB is completely customizable, from the categories you create to the order in which they appear. To make spending analysis as simple as possible, I created five major parent categories.

My 5 big budget categories

- Taxes (ugh)

- Savings (retirement, personal savings, etc.)

- Fixed living expenses (things like mortgage, bills, health insurance, etc. that I have to pay each month and don’t really change much)

- Variable living expenses (things like groceries and babysitting, which I could save money on if needed)

- Fun stuff (shopping, beauty, out to dinner allocations. All things I could cut out if I needed to save more)

- True expenses (those once-or-twice-a-year expenses that are necessary)

Why these simple budget categories work

Having these big major categories makes it easy for me to quickly calculate the percentage of my income that is going towards wants and needs. Sometimes this isn’t so good if I notice that the Fun category is over its budget. But sometimes this is good because it means that I can fund my Fun category and spend it without feeling guilty knowing I am meeting my Tax, Savings and Living expenses goals. I have actually created a separate category called “Oops I Spent Too Much” that I budget a little into each month so that if I do go over in any one category I can steal those dollars without guilt.

Put Savings At The Top

Put Savings At The Top

I moved my savings category to the top of my budget to emphasize that I need to save first, spend second. I changed the order of my budget to rank categories in terms of importance. Putting savings first keeps it at the forefront of my mind and allows me to trickle down money each month from most to least important. So if my “To Be Budgeted” bubble says I have $5,000 to budget for the upcoming month, I immediately put a percentage for taxes, retirement and savings into those categories, then fill in my fixed expenses, then variable, then true expenses and finally fun money. By taking out your important stuff first you realistically see how much you have left to play with.

Be honest with true expenses

My savings weren’t really savings because I dipped back in for True Expenses. This is one of the biggest lessons that YNAB has taught me. There are a lot of things that I pay for once a year: my gym membership (I get a free month by doing this), my auto insurance (I think I get a 10% discount), etc. I’m saving a lot of money by paying for these once a year, but I have to remember when these big expenses come up and to plan for them. I have a lot of these once-a-year-guys, and I used to pay for them out of savings. My savings each month would look falsely high before I’d take money back out of savings to pay for these bigger one-time expenses. My savings account was going up and down in kind of a two-steps-forward-one-step-back effect.

How YNAB helps track True expenses

YNAB accounts for these True expenses by having that money accumulate throughout the year. Funds accumulate in your account so that when it’s time to pay you have the money ready to roll. The first year you do this there is more planning because you might have a bigger bill due in less than 12 months time. You have to figure out how much to budget to “catch up” to that savings goal. But after a year, this should be so easy to do!

Tracking Spending Forces Honesty

Having the accountability of tracking spending works like a food journal in that it forces you to be honest and aware but gives you the flexibility to change. I can’t tell you how many times I have changed and adjusted my budget, but that’s all part of the fun! The YNAB app is so great because it does all the math for you. You can easily move money between categories, split transactions, move categories, re-order things, and fiddle with things to make your budget work for you. I can’t tell you how fun it is on the last day of the month to move any categories that I have extra money in to savings. I love how organized the app makes me feel.

From my experience, YNAB takes a little getting used to and the first month or two is a little tricky. I recommend watching this YNAB video on how to set up your budget. Once you get a feel for how this app works for your lifestyle, it gets better and better. You might need to re-think how you do your budget math and change some of your systems to get the program to work for you, but in time, it really will be life changing. Give it a free try!

Benefits Of Budgeting

Budgeting gives you freedom! When you know where your money is going and you have a spending plan on how you want to spend it going forward, you know if you have the cash available to make purchases on the fun stuff: dining out, clothes, spa days.

The reason YNAB is such a game-changing app for me is because it takes away all the mental math I used to do. When you spend on credit cards, you always have to subtract that amount of money from your checking account to know how much you actually have. A YNAB budget puts your money into categories so that you know what is set aside for credit card payments, your emergency fund, short term and annual financial goals, paying off debt, and everyday income and expenses you need to pay for. Your budget is a financial plan for the moment (vs a financial plan for the future and retirement years).

When you know where your money goes on a daily / weekly / monthly basis, you can better build that long-term financial plan and increase in your financial literacy on where you stand and where you’re going.

Put Savings At The Top

Put Savings At The Top

Jenn says

This is great…. if you make enough money to do it…. . It is very hard living off of a previous month’s pay in this day and age. You are very fortunate.

KathEats says

Actually the software is great for helping people stop living paycheck to paycheck and/or getting out of debt. Check out all the great information in the education and classes section on their website.

Paige says

We don’t live paycheck to paycheck but certainly can’t live off of last month’s income.

KathEats says

Well you could if you saved a little bit at a time and it accumulated a buffer. Read this. It’s not going to happen overnight (it didn’t for me) but in time it’s a smart goal to have.

Quoting the article: “Most people tell us it takes between 4 and 6 months, but it’s different for everyone. You’ll get there by living on less than you earn.”

Sara says

I wish that were possible for everyone. I think YNAB seems like a good resource but it really cannot be for every financial situation.

I am curious how you budget for last month’s income since, as you said as a freelancer, your income is not predictable. My sister and her husband are both in entertainment and generally work as freelancers. They have to use an accountant to do their financial planning. Luckily they make enough to keep those buffers for times when work is lean.

Also, what is the “household” expenses? Would that be cleaning supplies and toilet paper?

KathEats says

I put things in household that are living expenses that are needs more than wants – so yes like paper towels or stamps or other household supplies.

Kelsey says

I feel like this comment comes across as rather presumptuous. You say she could live off last month’s income if she just tried harder to save. That is just not a reality for some people. I think one of the main criticism people have with bloggers is that they are disconnected from the real world. I think you missed an opportunity here to be real with people – saying budgeting is hard, even I struggle, etc. – and instead come across a bit preachy.

KathEats says

My intention was to be encouraging that it’s not going to happen overnight (admitting that it didn’t for me – it’s never easy!) but to give a nudge that “certainly can’t” might not be the case with this program. Even saving a few dollars a week will make a difference in the long term. I have helped several friends with their budgets, and to say that I are disconnected from the real world hurts my feelings. It’s a huge misconception to say that bloggers are disconnected. We don’t live in bubbles. We are real people leading real lives with real friends. Just because I share what’s going on in my life doesn’t mean I am oblivious or not empathetic to the real struggles of other people.

Karen B. says

You’re right, Kath, it can be done and even on a small income. I did it and I’m an hourly wage worker at an entry level job. It’s not easy at first but soon you’ll grow used to having that buffer and wanting to watch it grow! I LOVE having savings! I keep saying to myself that I’m going to spend it on a vacation but I can’t bring myself to spend it. 🙂

Lillia says

It’s not always that simple though. This article is more about investing and Ramsey-type advice than about budgeting, but this is an important point: “Warren and Tyagi demonstrated that buying common luxury items wasn’t the issue for most Americans. The problem was the fixed costs, the things that are difficult to cut back on. Housing, health care, and education cost the average family 75 percent of their discretionary income in the 2000s. The comparable figure in 1973: 50 percent. Indeed, studies demonstrate that the quickest way to land in bankruptcy court was not by buying the latest Apple computer but through medical expenses, job loss, foreclosure, and divorce.”

Candice says

You are absolutely right. I’m a bankruptcy and foreclosure attorney. Most of my clients aren’t struggling because they were extravagant or lived beyond their means. They struggle because of things outside their control. Health insurance, unemployment, sickness, disability, foreclosure, etc. YNAB is great-I have used it. But it’s definitely for people who need to get spending under control. It won’t do anything for someone whose necessities are higher than their income.

Jen says

I understand what you mean. You have to have a full month’s income to live off of before you can start the program. The software is designed to help with not living pay to pay, like Kath says, but you do have to get that first month’s expenses “banked” first in order to use it.

KathEats says

Actually you don’t need to have a buffer to get started! This article explains how you can save up a buffer to live off last month’s income over the course of a few months. You can started right away!

Mel says

I don’t use YNAB that way and I’m fine. It’s not mandatory at all–use the software however you want! I budget money that I get each paycheck, twice a month, and put money into a bunch of different savings categories. I would prefer to put the “buffer” money into an emergency fund.

Jen says

I need to give this another try. I’m also fully freelance and pad my checking right now. One question. YNAB doesn’t actually move the money between your accounts, does it? I mean, you still have to log into your bank/mortgage/etc to do the transaction?

KathEats says

Correct. But with the YNAB system, you don’t really even need to move the money. Your bank account might seem higher but one glance at YNAB and you’ll know what funds are reserved and which ones are available. So if you choose to, you don’t have to do any transferring or extra account opening.

Jen says

Right, so checking will be high if all monthly payments and variables are in there, but you have to “physically” move money over to savings or to retirement accounts. I figured, but wanted to ask, thanks! I want to give this a try again, it’s hard to wrap your head around at first.

KathEats says

Yes that’s correct. Or you can just keep the savings in the checking account and know it’s reserved for emergencies. You can quickly check the balance in YNAB. And you could even keep the retirement in there too until you’re ready to transfer to your IRA. Or you can have 50 different accounts and do lots of transferring : ) It’s all up to you and how you like to organize things. I have simplified my number of accounts since using this.

Jennifer says

We used YNAB several years ago and I didn’t find it super user friendly. It was probably me not giving myself the time to really figure it out. We’ve been using Dave Ramsey’s app “Every Dollar”. It’s really basic, user friendly, free and perfect for us. I do like how YNAB has you live on last month’s income….that was a new concept for me.

KathEats says

I think YNAB has gone through a major overhaul in recent years, and now everything is cloud based. But if you have an app you love that’s great. I’m going to check that one out.

Jennifer says

We’ve been using YNAB for a while now and love it!

Kelli @ Hungry Hobby says

This is great, my hubby and I have been using something similar with a budget ap to track our spending but this seems a lot more controlled!

alan says

Have you ever tried Quicken by Intuit (at least I think that’s who is owner these days)? I have used Quicken for 22 years and it does a great job record keeping (if I keep up with it, that is). You can break down where your expenses are.

If you have tried Quicken (or others have), how does this software compare? Also, what is the security for this software? Is this cloud based or install on your home PC? Thanks Kath for always thoughtfully composing these blog posts.

Sam @ Hygge Wellness says

Thanks for sharing! As I start my own self-employed journey, I may need to check this out : )

Mara says

I’ve gotten a lot of recommendations for YNAB from friends who love it, but I have a lot of hesitation about giving all my personal banking and account information (including username/password, etc.) to a third-party website that stores all of this information in “the cloud.” I wish they still had the option to join YNAB and download the software onto your computer, so that the information is stored locally.

I think for many security-conscious individuals, this is just too risky.

Margaret says

That is a really good point about the security issue. I was thinking about giving YNAB a try, but I didn’t realize you have to give them access to your bank account login and password information. Too risky.

KathEats says

You don’t have to – it’s optional

Amanda says

You can still download YNAB4 which is the desktop version. They’re supporting it until the end of this year, but it will probably stay working for much longer.

Claire P says

Hi, I actually use YNAB too and I chose not to link my account information. I’ve been tracking my accounts and transactions manually instead of linking everything to sync automatically. It takes a little bit of effort, but if I log my transactions in the app in the moment, and then once I week I try to do a reconciliation with my bank account and credit card.

I think I’m still confused about how YNAB handles credit card transactions, but I’ve found the YNAB reddit page to be super helpful!

KathEats says

Yes was going to add you can put in transactions by hand (even on the go with the app) and then there’s a little “C” to check when they have cleared

Emily says

Do you know of any apps that support international banks? Since moving to Guatemala, I haven’t been able to use Mint because they won’t connect to my bank here.

KathEats says

I am not quite sure

Breanne says

I tried this at the beginning of the year and really struggled with the system, especially the way it links to the bank and the money you have already. I just went back to Mint because it made so much more sense, even though I love the idea of using “old money.”

Andrea Johnson says

I’m going to try it – thanks for the inspiration! I love that organized feeling. 🙂

Andrea Johnson says

I went down a rabbithole of clicking and somehow ended up at my post from over a year ago and just wanted to say, I still use YNAB and I love it – thanks so much for the recommendation!!!

KathEats says

YAY! I still love it too!!

Ashley says

I love YNAB!

Robin wiergacz says

Great post. I pretty much try to do this on my own. Instead of accumulating it in my checking (for those big once a year expensives) I move it into an account set up just for those needs. Since I do the majority of my banking online anyway. I found it was too easy to get to in my checking if I really wanted something.

KathEats says

That’s good idea too!

Sarah says

Thank you so much for this post!!! The timing of it was crazy! in the last few weeks, my husband and I have talked about how badly we needed to get back to a budget. We never liked any of the software we tried, so I decided to give YNAB a try after reading your post. WE LOVE IT!!! Although we just started using it, I can see how helpful it will be. I LOVE the idea of living off of last month’s income since my husband is in sales and each month is variable. Thanks for letting us know about it!

KathEats says

Yay!

Connie says

I may be a few years late, but absolutely love your post. I’ve been a bona fide mess with my finances for YEARS! I even tried YNAB for one day in 2017, I gave up because I was scared and not ready to face the music of where my money was going, all the years I’ve wasted and how can I move ahead. I started again one week ago, signed up for numerous webinars and most of all, forgave myself for the past. I’m now beyond obsessed 😀 I really like the way you set up your categories, so sensible. I’m a single parent, working full time and now part time to get ahold of my finances, it’s already hsppenimg because I stopped shopping, receipts aren’t piling up and I’m now focused on my Buffer which I’ll be starting. I honesty feel so much better about myself and my finances 🙂

KathEats says

Yay! You can do it. It’s so nice to have control.

Paul says

I started using YNAB in January 2017. Now, 18 months later the age of my money hovers around 70 days. I usually have this month and next month fully budgeted. It has literally changed my life. I have reduced the number of bank accounts I use to 2. I have 1 primary checking account and 1 primary savings account. I transfer money to the savings account to get higher interest. I always keep enough money in my checking account to cover any bills for this month. I use many credit cards and love the way YNAB handles credit card transactions. I normally pay a little more than the credit card statement but not the current balance. But it doesn’t really matter because the money has already been allocated to pay the bill in YNAB…

I can’t say enough about how well YNAB works for me…