I’ve been budgeting with You Need A Budget (YNAB) and love the app! Here are 5 budget tips using the YNAB four rules and my YNAB review. This post is sponsored by You Need A Budget

If you’ve been reading KERF for years, you’d know that I love budgeting with YNAB. While it’s not always fun to not buy something because of a budget constraint, I enjoy keeping a close eye on my spending and saving, as it makes me feel super organized! It’s quite a necessity as a self-employed businesswoman. I have tried all kinds of budgeting methods and even shared my own spreadsheet a few years back in my NERD KERF series. I truly believe that just like staying mindful of fitness and nutrition is important for living your healthiest life, keeping a close eye on your spending is imperative to healthy finances.

What Is YNAB?

Enter You Need A Budget (YNAB), a personal budgeting web app that does all the organizing for you. I have three months free for all of you readers (no credit card required) so check it out here if you’d like to give it a try.

YNAB vs. Mint: Which is better?

YNAB by a landslide!! I think Mint is great for seeing ALL of your accounts at once – investments, retirement, property, college savings, checking, credit cards. I think Empower (formerly Personal Capital) is better than Mint as a net worth tracker. Their retirement calculator is the best I’ve used.

But YNAB is by a landslide a better budgeting app and better way to track your spending. I only have two accounts linked in my YNAB: checking and credit card. I have about 10 linked in Mint. So the two apps serve very different purposes for me. If I had to live without one, however, Mint could go.

The YNAB Four Rules

YNAB teaches four rules that help you take control over your money:

Rule One

Give every dollar a job (predict what your expenses will look like before they happen)

Rule Two

Embrace your true expenses (those expenses that aren’t monthly regulars but pop up by surprise)

Rule Three

Roll with the punches (be flexible! you are always in charge of your own budget and can change it)

Rule Four

Age your money (build enough of a buffer to stop living paycheck to paycheck)

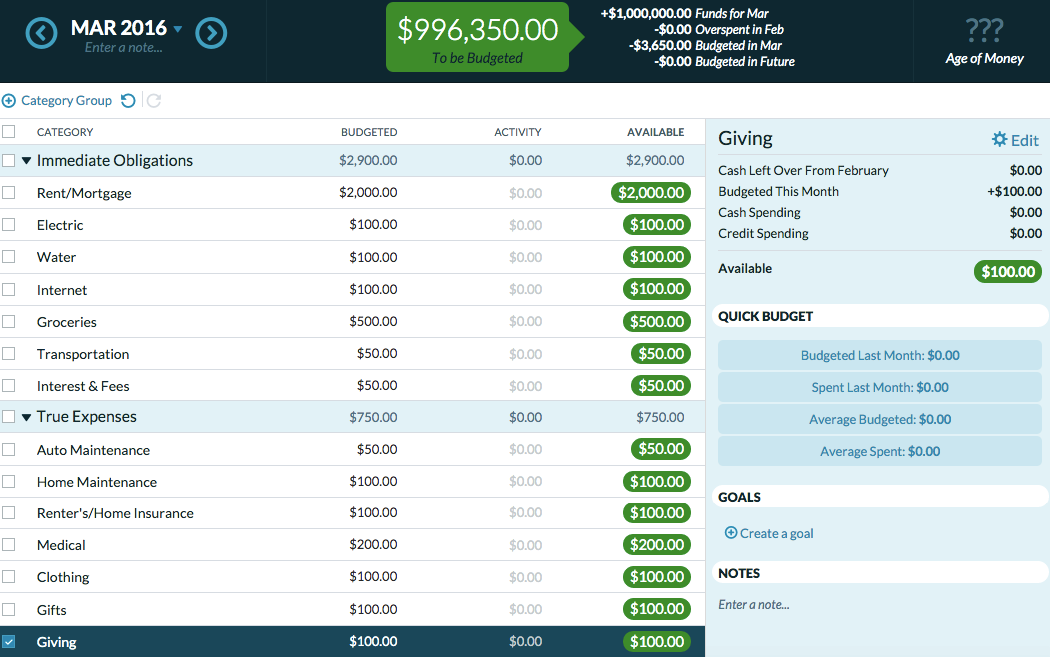

{You can see I was quite ambitious in March earning 1,000,000!! Mwahahaha!}

5 Tips For Budgeting with YNAB

I’ve been using YNAB for a month now, and there are many things that I really like about it. Basically it took my old spreadsheet system and made it a lot more legit. YNAB takes away all the tricks and keeps a nice register for you. I love that is has consolidated my budget system from multiple online spots to just one with everything all in one place. Here are some of the tips it teaches you and some I’ve put into practices through my years of budgeting:

1. Treat savings (and retirement) like an expense.

When I started budgeting this was my number one lightbulb moment. Rather than spending everything and then seeing how much was left for savings, I started treating them as expense entries and then whatever was left at the end of the month was what I had to play with for fun things like going out to dinner or new pillows for my couch. Retirement and savings shouldn’t be afterthoughts – they are very important parts of being a grown-up and making sure you will always have enough money for basic needs, so treat them that way. YNAB’s “give every dollar a job” rule helps you do this with complete ease as you break down your income into categories at the beginning of the month.

2. Minimize spending categories.

A lot of budgeting and money management apps will break down your expenses into a million little categories that are overwhelming. Personally I don’t really care if I spent my extra money on cappuccinos, wine or pillows for the couch – all of those are “wants” not “needs.” And those are the two categories I use – wants and needs. I divided my budget into these categories: mortgage, bills, groceries, auto, needs, wants, true expenses. Simple. YNAB allows you to customize everything so after a bit of a reorganization in the beginning I have the program working like I do.

3. Don’t underestimate one timers aka true expenses.

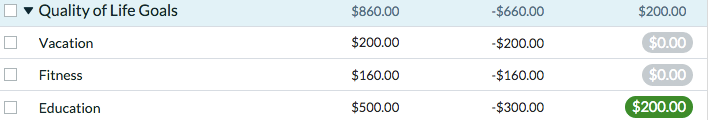

I have always called them One Timers, but YNAB calls them True Expenses. These are the important payments that come up once a year, quarterly, or unexpectedly. Often times you can save money by paying for something once a year instead of once a month. I also like to minimize the number of checks I have to write, so I pay for things like our gym membership and Mazen’s preschool once a year instead of monthly. We save money on auto insurance and my blog management company by paying once a year. But the months when these expenses come up, you better have enough money to cover them! Thus, you need to budget for True Expenses monthly even if you pay for them by the year. YNAB makes this process so easy – it’s my favorite feature of the program!!

4. Check in daily and you’ll recognize spending as/before it happens.

As I said in my first paragraph, I believe that checking in with your accounts daily really helps you keep on top of your spending. You might see something autodrafted for higher than you expected, or on a positive note, you might see that you were paid a lot more than expected for an affiliate and have more money to spend that month! YNAB’s apps (for both Android and iPhone) are perfect for this.

5. Allow your money to rollover.

Embracing Rule #4, letting your budget rollover really teaches you the benefits of saving. This was a big weakness in my spreadsheet budget which just wasn’t tech savvy enough to do this. Rollovers would have helped me average my income from month to month instead of having a really good month followed by a really bad month. YNAB’s software does this automatically, so big thumbs up!

YNAB has free daily, online classes and it’s actually free for all students. For the rest of you guys, you can get a month free (with no credit card needed) by clicking here!

Nikki says

If you dong mind sharing, how much do you budget monthly for groceries?

KathEats says

$400

Sara says

Kath — this sounds really cool! I love spreadsheets too, but I love the idea of keeping my budget on my phone. Does your grocery budget include eating out? That’s the one area my budget could use some improvement! It’s just so easy to grab a fancy juice or stop by the hot bar at Whole Foods when I’m out running errands instead of eating at home : ) Any advise there?

KathEats says

It doesn’t. That goes into the “fun” categories to emphasize that they are fun and optional and not necessities

Liz @ I Heart Vegetables says

Those are great tips and that sounds like an interesting program! We have all of our budget stuff tracked in a spreadsheet but this would be a cleaner way to keep things organized!

Kristen says

I started using Mint several years ago based on your suggestion. This looks really similar! I obviously like the idea of this site because I use Mint… so I’m wondering what is so different about it that they charge $$ for the service. Is it the classes they offer that make the service different? Do they not have as many advertisers on their site? That is the one thing I don’t really like about Mint- all the offers for refinancing and auto insurance etc. etc. How do you think YNAB stacks up against Mint? Sorry for all the questions- I’m intrigued 🙂

KathEats says

The biggest difference is you can change and enter things. The budget is front and center and the transactions are all changable. I guess you can do budgets and change things in Mint too, but this just seems more like a personal budget and less like a reflection of your spending. And yes – no ads!

kat says

I’ve always thought of Mint more as a spending tracker rather than a budgeting program. And NO advertisers in the YNAB online budget or the apps! 🙂

Jen says

I’ve been wanting to try this, thanks for the free trial! I’ve also been budgeting for years and have a hard time with those once a year expenses, gift buying, one-off donations, etc, so I’m really excited to try it!

I don’t have any budgeting tips, but I do, at least once per year, try to lower our bills (cell, cable/internet, home/car insurances), and am usually successful! Another thing I’ve done is choose my power provider. I didn’t realize you could do that, and still have your regular gas and electric bill. I managed to get 100% wind power for a lock in price of under 9 cents/kwh. More than standard power plant electricity, but totally green.

Callie says

Please tell me your secret to buying a weeks worth of groceries at Whole Foods for $100! I know you eat out a lot, how much do you put towards that?

KathEats says

Shop the perimeter and don’t buy a lot of meat!

Sam @ Barrister's Beet says

That’s what I do! I get creative with protein sources. Meat kills the budget. And add ons, like dressings (just use EVOO and vinegar that you already have instead of spending $5 on a bottle of dressing!). I also stopped buying snack fodos and just eat raw veggies, hummus, fruits/nut butter, etc. as snacks now. It’s a lot cheaper. OH, and frozen fruit! Especially for smoothies. Much cheaper.

Nerdsamwich says

Or go somewhere like Costco or Winco instead of Whole Foods. You’ll get a lot more groceries for a lot less. Costco paper towels alone are worth the membership, as are their diapers. I wish they had some non-organic options, but no place is perfect!

Linda @ The Fitty says

I love grocery shopping but I have enough food in the fridge to last myself a while, so I’m not allowing myself to go out shopping until all the stuff is done. One of my culprits is buying things I don’t need!

Nicole says

Something I really like about YNAB is the ability to sync your expenses with your online credit card/banking sites. I was never able to get this functionality to work well with Mint, and I’m finding it works great with the new version of YNAB. If you forget to add something when you make a purchase, this is a great double check.

Really intrigued by your idea of doing the broad wants and needs categories. My husband and I have a lot of little categories and sometimes it feels confusing/overwhelming to pick where things go. I’m going to share this post with him and continue our conversation. Thanks!

kat says

Hiya! I *love* your blog and also love YNAB- started with YNAB3 and am now totally hooked on the new version! Just wanted to clarify that the new YNAB (that you reviewed) is not free for students — only the previous YNAB 4 version 🙂 This is probably way more important to my 18 year old than to most of your readers but I thought I’d point it out anyhow 😉

Have a great day!

Sam @ Barrister's Beet says

Thanks for sharing this! We don’t use any sort of budget tracking program, but I would love to get a better idea of where my money goes each month. I started making coffee/breakfast at home the last few months, which has had a huge impact on my monthly expenses. I used to treat myself to something after the gym because I just liked having somewhere to stop on my way to work before a long day… but I realized I like the savings much more!

India says

I love using the app GoodBudget. We used to use the Dave Ramsey cash system, but it didn’t work for us. I like it because it allows me to keep track of everything right away. Highly recommend!

Danielle says

Nice post, Kath! I personally have used Mint for like 10 years but I’m really interested in this program, too. I may use the free trial and compare & contrast.

Rachel says

I wonder, as a self-employed businesswoman, how you handle saving for taxes? It’s so hard! My husband and I are both self-employed, and put away 25% of our income every month against our estimated tax payments – but it means we never manage to also save money for other things!! You seem so together financially; do you have advice for other self-employeds that are striggling?

KathEats says

It sucks doesn’t it!! But I guess we all pay taxes somehow. One big tip I do have is in April when you get all of your self employment vouchers for the upcoming year, go ahead and write all the checks, pre-date them, address and stamp the emvelopes. That way each quarter you just have to make sure you have funds ready in your checking account and mail them. No more hunting down the correct address or double checking that you have the right voucher, etc. Saves me so much time to do it once a year instead of 4.

Emily says

What software do you use to do the accounting for the blog? QuickBooks?

KathEats says

A detailed spreadsheet actually. But a lot of my colleagues use QBs and love it

Jennifer Valdes says

Just wanted to comment that we use YNAB, too, and love it! It’s so easy to track spending on the go.

Kimberly Long says

This was an informative post kath! I know that you eat out often, is that something you budget for? Or just eat out when you have the money. We only eat out once a month and we definitely budget for it.

KathEats says

Yes that goes into my “entertainment” aka wants budget. Not a necessity but accounted for.

Stephanie Baumann says

Thanks for the info on YNAB! I have been using a google doc spreadsheet for awhile now, but just like you, it just isn’t technologically advanced enough to meet all of our complicated budgetary needs. I am definitely going to have to check this out (especially since I’m a student!)

Bree says

I had such a hard time with YNAB; I tried it for a month at the start of the year and hated it every day. I went back to Mint. I always like to try new ones just in case 🙂 (A friend of mine swears by LearnVest.) There are features in YNAB that I wish Mint had (like the custom categories and the roll over look, though you can roll over on Mint), but on the whole I like that Mint pulls in my records for me. I go into my Mint and review my goals regularly so that daily look is still something I’m in tune with. I could talk about budgeting all the time, haha.

Ella says

my husband and I use an app called “HomeBudget.” You have to manually enter every purchase you make, but there’s something to that practice that makes you really think about your spending. You set up whatever categories you want (similar to what you’ve done on your various programs over the years) and then enter as you go. It’s been great for us.

Elise says

I’ve started shopping at a local discount grocery chain for 90% of the groceries I use during the week. I eat a vegan diet so I’m already using cheaper proteins like tofu and beans, but I’ve started being more intentional about meal planning so I can cook up dried beans which are much cheaper than canned. Also, this chain has an app and they have been doing amazing coupons like $10/$50, so I’m saving a lot by paying attention to that as well.

Hannah @ eat, drink, and save money says

Perfect timing! I literally just took a break from working on my monthly budget excel sheet to read your blog. I love tracking my money! I’m so excited to check this out.

My favorite budget tip is to set a goal. Saving is no fun if you are only saving to save. My husband and I like to have big goals to meet then we give ourselves little rewards once we meet a savings goal.

Kelly Hibbs says

Great post – do you know if this is an American only website? I’m in New Zealand and wondered if it would work with my bank etc?

Thanks!

KathEats says

I don’t believe it will. At least I don’t think it will auto sync with international banks.

Jessica says

I must have missed it, but what is your new financial relationship.

KathEats says

https://www.katheats.com/sharing-my-heart-out

Mary says

Hey! Just wondering why you budgeted 1,000,000 dollars for March? (Muahh hahh hahh!). Is that a joke that I missed in a previous post, or something? I’m all for budgeting, but this seems like you are mocking those of us that have a more realistic income.

KathEats says

I just picked a random number to put in that you would know to be obviously fake.

Katie says

Kath, this was such a great post, as were your older ones that I went back and looked at. Thanks so much! You inspired me to simplify my categories into just a few like yours (his, hers, ours, and needs), and I can already tell this is going to be SO much better!

The thing I am still never sure about are those rare expenses like plane tickets for a vacation one month. They mess with my monthly budget. Even if I let the “ours” budget roll over each month, I have to wait, say, a year before I can see if — on average — the “ours” category stayed under budget each month during that year. You know what I mean? So then I feel like that whole category is not very helpful each month. Any suggestions?

Thanks again 🙂

KathEats says

Totally know what you mean. What if you have another category for “one times” or something for those bigger expenses? I often pull them out of my “ours” budget and have them in some extra category like travel or business.

Chelsey Hoffmann says

Are you still using mint? I was wondering if you found you prefer one over the other?

KathEats says

I haven’t stopped using it so I’m using both right now. YNAB is a lot more customizable

Katie @ Talk Less, Say More says

I’ve always had to find my own system for budgeting and exactly what works. Lately I’ve been using my debit card more than my credit cards just to keep that debt from rising and managing my money just that much easier.

Alexa says

I really like the YNAB toolkit as well. I personally like the ‘Days of Buffering’ metric over the ‘Age of Money’ metric. The Tool Kit will show it. It also does a lot of other cool stuff.

https://chrome.google.com/webstore/detail/toolkit-for-ynab/lmhdkkhepllpnondndgpgclfjnlofgjl?hl=en

Anyway, I am totally obsessed with YNAB. I’ve been using it for about 30 days now. I wish I had waited to try it though, as my free trial is almost over and your offer of 3 free months is much better than the free 34 days you get from going straight to their site!

Katie says

Hi, I just tried your three months free offer but it’s only for 34 days! Did I miss out on the longer offer?

KathEats says

Hmmm that’s the standard one not the KERF one. I’m sorry about that. Let me investigate

KathEats says

So even though it states 34 days, it’s 3 months! They are changing the language to make that more clear. So you should be good!