Curious what other people’s spending habits are like? Me too! I surveyed my audience and asked you guys to share. Here are the findings!

Spending Habits: A Glimpse Into Real Life

I have always loved numbers

Math was my favorite subject growing up. I’ve always loved crunching numbers. This started young and I think is a large part of why I was always a good student. Learning new things and getting quizzed on them was a game I was always up for the challenge of going for a 100 on the test. (And the reason why I liked math’s one right answer more than English’s subjective responses.)

I love spreadsheets, trackers, and goal setting.

This propensity toward numbers is why when I set out to lose weight years ago counting calories was fun for me. It’s also why I love creating spreadsheets and projections for my business. When I started a spending budget after getting my first job, keeping track of my money was something I naturally loved. You can actually see how I structured my very first spending budget in this video. (LOL at only spending $200 on groceries!!)

Budgeting helps me feel organized.

I used spreadsheets for years until I was turned on to YNAB (You Need A Budget), the absolute best budgeting software there is!! You can read my review here. And check out this post for tips on how to set up a budget. I am always trying to be as efficient as possible in all areas of my life, so money is no different. How can I squeeze out some money here so I can put that money towards this goal there?

I also love the psychology of how people make decisions.

It’s why I was attracted to nutrition and why budgeting is fascinating to me. I don’t care as much about the granular of investing, but I am most interested in the choices people make when spending their money. I’m interested in your grocery budget and savings rate and how your spending reflects your personal values.

But unlike food, not everyone shares their spending habits!

I have found a few podcasts that use real numbers as case studies. I’ve loved the Finance Friday Edition of Bigger Pockets Money. They interview people who would like help making a plan and go through income, expenses, net worth, and saving. I also discovered Ramit Sethi’s podcast through Bigger Pockets: I Will Teach You To Be Rich. He interviews couples as well to talk real numbers. It’s part therapy session, part financial advice! Ramit has a book too.

“Many people teach us how to save but nobody teaches us how to spend” -Ramit Sethi

So that’s all why I wanted to do this anonymous survey about money! To get a little glimpse into people’s lives and the decisions they make about money.

Spending Habits Survey Results

Limitations

More than 100 people took the budget survey! This was obviously not a scientific study. The sample size is narrow – KERF readers with internet access – and those who opted to fill this out might have a tendency to know more about money than someone who chose not to. I also did not distinguish between currencies, adults vs. children as members of the household, or create a way to filter cohabitating adults vs. single people vs. married combined households. So take all this data with a grain of salt!

The Responses

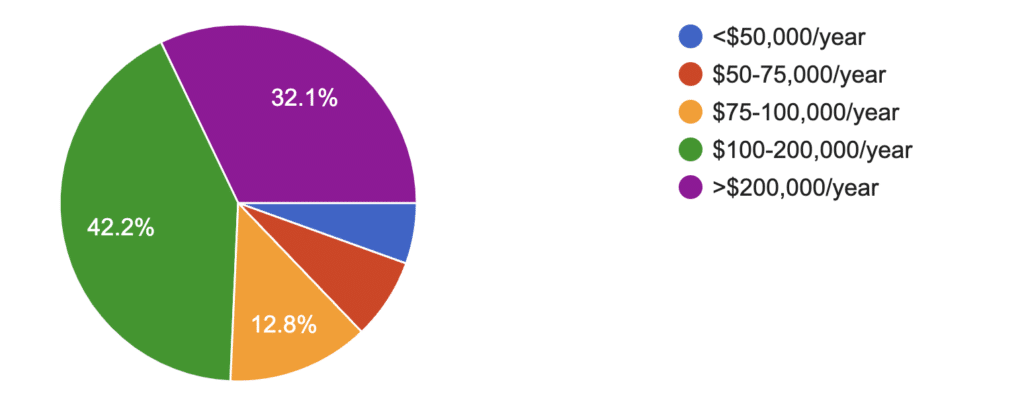

What is your annual combined household income?

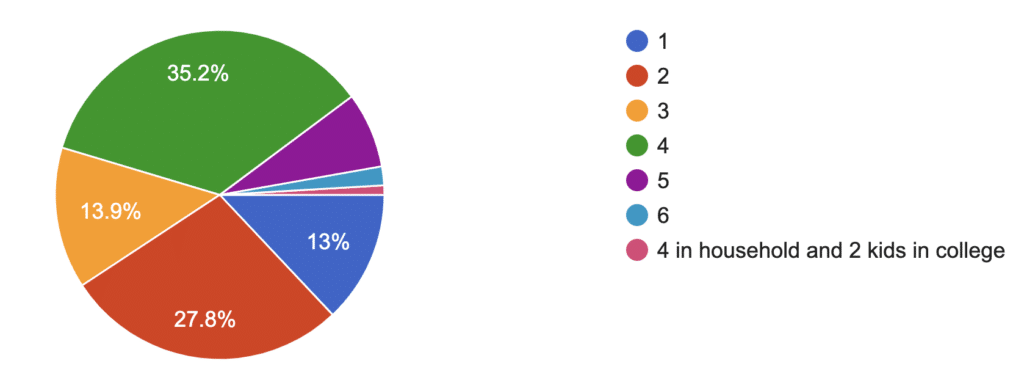

How many people are in your household, including you?

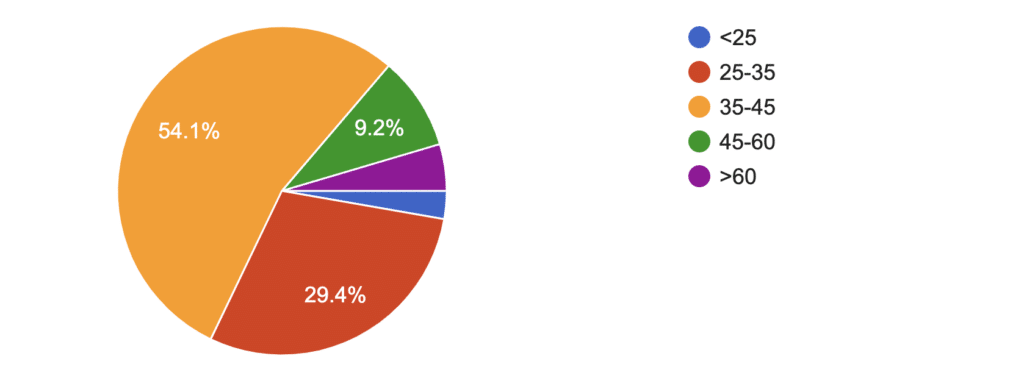

How old are you?

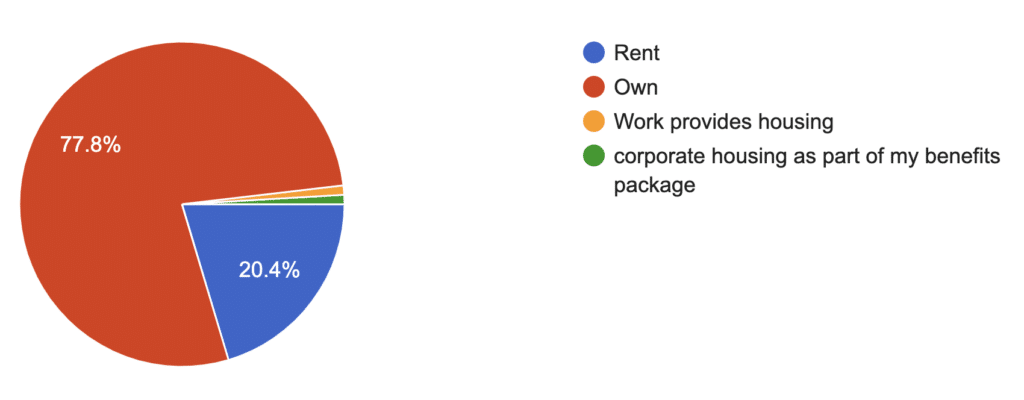

Do you rent or own your home?

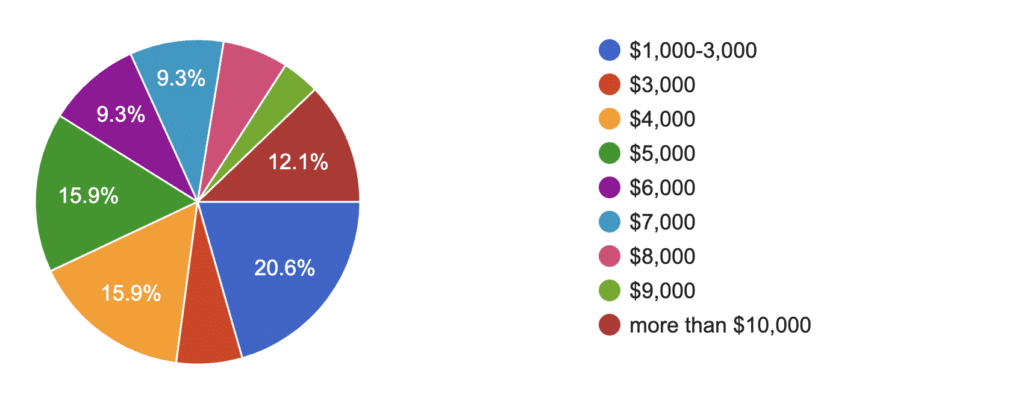

How much do you spend each month? This includes everything (housing, food, childcare, medical, insurance, clothing, spending money, etc.), but not savings.

I would love to dig deeper into this question!!

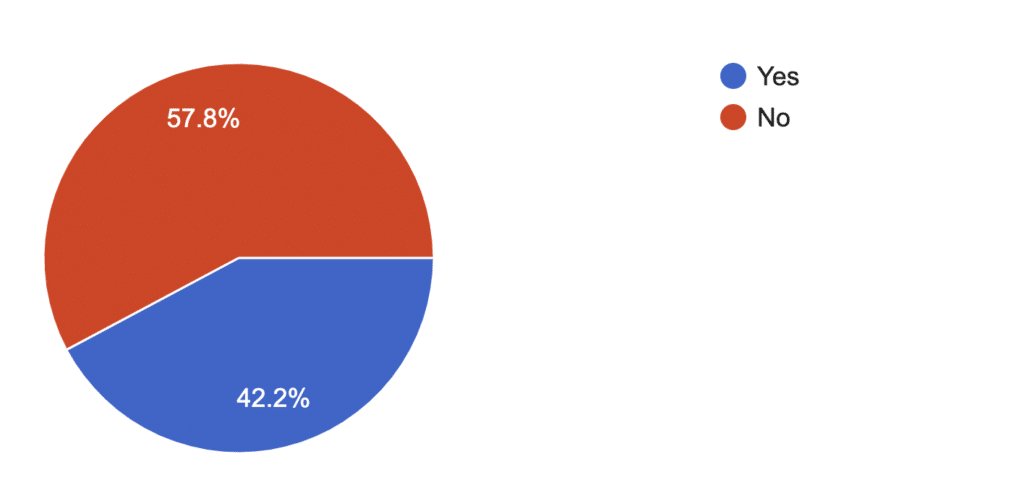

Do you have a monthly budget?

I’m curious how those of you without a budget manage or track your money : )

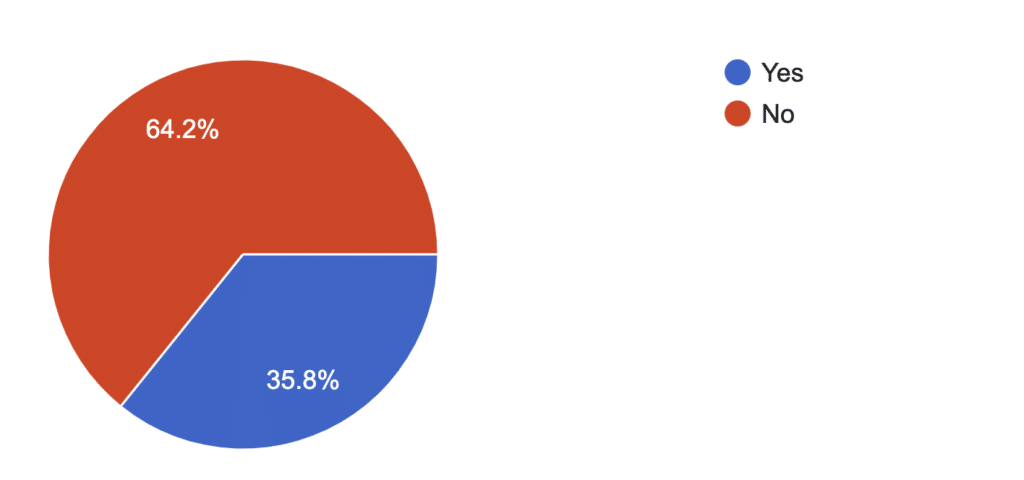

Do you have debt aside from a mortgage?

The types of debt were:

- 24% student loan

- 16% credit card

- 8.5% personal loan

- 17% other

- 57% I do not have debt

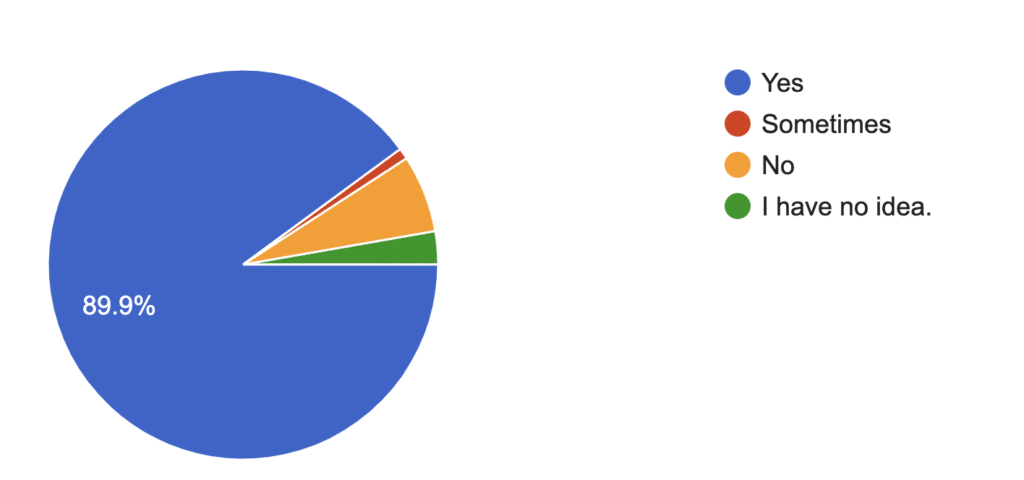

Do you or your partner contribute to retirement accounts?

Impressive!

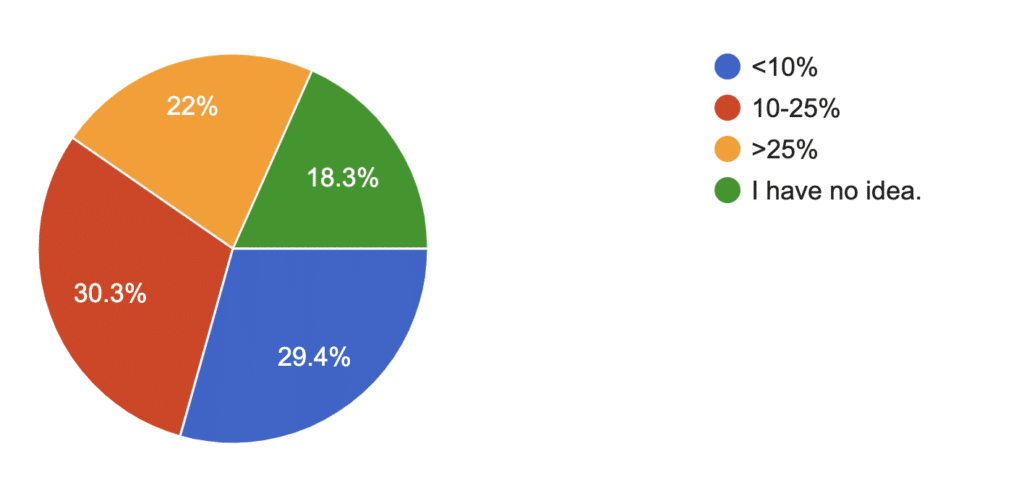

What is your savings rate?

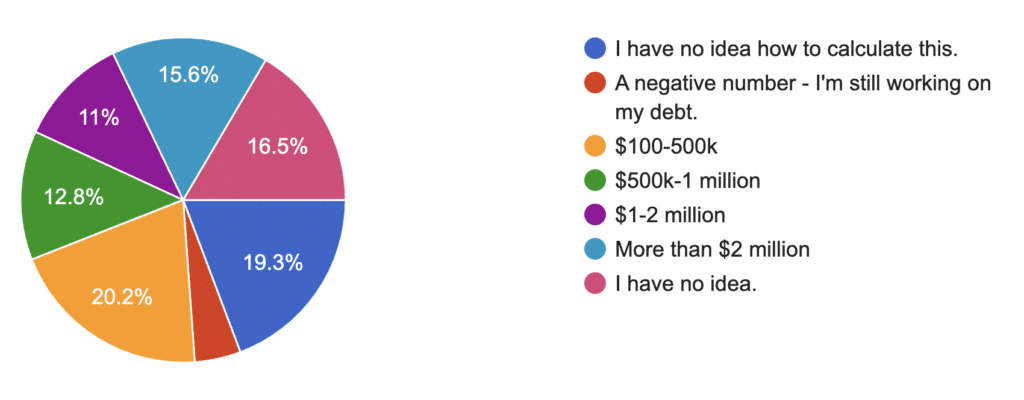

What is your net worth?

Is there an area of your finances/budget that you struggle with the most?

The top responses were:

- Saving/investing

- How to budget

- Planning for the unexpected

- Food/dining out

- Impulse spending

I identify with these common struggles!

Share anything you want about your money journey!

Reading these were my favorite part. Some great wins like paying off debt and great savings. I didn’t include them all, but got a good mix.

- Just climbed out of major debt after a change in employment/ unemployment.

- Student loans are the worst!

- Expenses like IVF have thrown all budgeting attempts out the window! And we’re trying to buy a house but the market here is insane. We just lost a house (listed at $1.4M) to an all-cash buyer at $2.215M. HELP!!

- Student loans have been a huge barrier to saving money. I think we are pretty conservative on money spending and do not have debt outside of student loans and home mortgage.

- How do I get a mortgage in NYC lol?

- I am someone with quite a modest trust fund (I have to work, but really only enough to satisfy the rules of the trust) and I want to buy an apartment that is a co-op or condo. But there are extremely strict rules! If you could walk people through that, it would be a super-interesting post!

- Having a budget helps me feel calm, I don’t see it as restrictive but more as a tool to reach our long term goals. We don’t follow it perfectly each month but retirement savings and extra to the mortgage each month are musts.

- My partner and I took advantage of the zero percent interest on a student loan (interest stopped accruing due to the pandemic – best thing to happen!) and kept making regular payments and now it is paid off!

- We have invested in real estate in the Miami area – buying homes (and now buildings) and renting them, mostly residential but dabbling in some commercial as well.

- Don’t have a set budget but we are both quite frugal so it works itself out. When we really want/need something we get it but otherwise we get by with what we have. We each have splurges but don’t need to keep track because it’s never out of control.

- Automating everything and having any money attached to my debit card be spending money has been a game changer! If I can “see” it I can spend it. All bills, savings, goals savings come out before we each get our “allowance”.

- Many years of grad school and doing everything 100% on my own left me with no savings or retirement! Now that I have a good job (using my degrees!?), I am 100% focused on saving so I can travel one day. It’s been a decade since I’ve had a vacation.

- We have a nice amount in savings. Baby due 4/2 so looking into investing for baby’s future as well. Hubby dabbles in crypto and some stocks. No real debt besides mortgage, car loans. Hubby owns his own businesses (5 of them) so our income can fluctuate dramatically month to month (I have a stable 9-5 job).

- Becoming debt free has been a blessing in being able to start saving money in general as well as being able to begin collecting towards a down payment on a home in the future.

- We’re DINKS and really spend a lot of time thinking about FIRE. We max out all possible retirement accounts (401ks, Roth/Traditional IRAs, HSAs). We don’t actively budget (because we’re lucky enough to not really have to), but I keep a very close eye on our accounts and we use Mint daily to keep track of everything.

-

Roughly 1/3 of our savings is from inherited wealth, so I don’t like counting it.

- We save a lot here in Alaska because it’s harder to casually shop or travel locally, but that means we spend more on shipping luxury goods and traveling farther!

- One thing I am very proud of, that I wish others took more seriously, is the idea of living not just within your means, but WELL BENEATH your means. My husband and I always did this as singles, so it’s easy to continue as a couple. Our incomes have increased over the years, but our expenses haven’t (now that we have no more daycare costs, they’ve actually decreased!). It’s so easy to save and invest money when you have this mindset. It sets us up for early retirement and a lot of freedom & flexibility should one of us want to pursue a different passion or not work altogether.

- I always find your money posts interesting! Our combined income is nearly 200k – which I know is significantly higher than many many people. But we’ve handled our finances in a similar way when we were making less than half that. We have our accounts set to up automatically transfer a certain amount to our saving account, retirement accounts, and kid college funds (we have two kids). We both contribute to our work retirement accounts – my husbands company matches 10% – mine far less but we meet or exceed the match. The only debt we have is on the house (but may be adding a car payment this year – one is about to die…). Our attitude is that we if we are able to meeting our savings goals, we don’t have to micromanage the rest of it by having a budget. It works – a couple times a year we transfer extra money out of checking to savings. We also don’t really have expensive tastes so that helps.

- I did not have a monthly budget until the pandemic hit and I was worried about losing my job. I have no idea if I am doing it well or the best way I could be.

- When we married, and I still worked full time, we lived only on my husband’s income (saving mine) which gave us the flexibility for me to return to work part-time when our first of two children was born. He now earns a larger salary and we moved states and I am still working only part-time and saving my income.

- We got really lucky with some early employee stock options that allowed us to leave our jobs. It is not normal, but it is nice not to work for someone!

-

YNAB is the best thing that ever happened to my money.

AMEN on that last one! Haha.

More Thoughts On Spending

How to calculate net worth

Almost 20% of people checked the “I don’t know how to calc this” box so I thought I would clarify! Your net worth is all of your assets (cash, investments, home equity, retirement accounts, etc.) minus any debts you owe (mortgage, student loans, credit cards). It’s not uncommon to graduate from college with a negative number and then as student loans are paid off move into the positives and keep climbing. Net worth is a net number, so you could have $1 million in net worth if you have $10 million in real estate and $9 million in mortgages or if you had $1 million in investments and cash and zero debt. Obviously those two situations are very different!

What is a savings rate?

Your savings rate is the gap between the money you earn (after tax) and the money you spend AKA how much are you saving? If you bring home $100k and spend $80k that means you’re saving $20k, or 20%.

This is one of the most popular articles on savings rate from Mr. Money Mustache. Note the cool chart he included with savings rate percentage and years to being financially independent. This savings rate calculator can help too! You will need to know how much you spend and how much you save to be able to calculate this, and if you don’t know those numbers you should do a little tracking! It’s good to track at least once a year and see where your spending habits fall.

Fixed vs. Flexible Expenses

I hear a lot on the podcasts I listen to that your big fixed lifestyle expenses are the most important: housing, food, transportation. If you can find a way to keep those to a smaller percentage of your spending then you will be able to have a much larger savings rate.

An example of this might be renting out the basement of your home to offset the mortgage, choosing to live in a lower cost of living area, or becoming a one car household if you live somewhere that biking and walking are feasible. Obviously not everyone can do everything, but there are many creative ways to house hack or reduce these fixed expenses.

When fixed expenses are low, then you can bump the spending on your flexible expenses up when you can and if times get tough, like a job loss or pandemic crisis, you can easily cut out the extra and still be OK.

Elizabeth says

I LOVE Ramit’s podcast. It’s such a fun and informative listen. So important for couples to be on the same page about money. Glad you are talking about this. Saving, especially in your 20s and 30s, can really pay off. It’s harder in those years because salaries are lower and expenses can be higher with little kids, but it’s so worth it. I’m 51 and hoping to FIRE in 5-7 years. I’m listening to and learning from personal finance podcasts like it’s my full time job!

Kath Younger says

Yes I’ve been loving hearing the stories!! Congrats to being close!

Anna says

With the national average income being around $67,000, these results might be a little skewed considering the majority of responses were from families with $100k+ incomes. It’s great that some folks have inherited money or the large number of those in this survey who are fortunate enough to live debt free but I don’t think this represents the vast majority of families/individuals.

Regardless, this was helpful to understand concepts like net worth, etc. My partner and I are in our 30s and have a very negative net worth due to student debt and credit card debt, and don’t have much in savings. We spend frugally and pay off debt as efficiently as possible. I hope one day I can at least get to $0 net worth or maybe just save something toward retirement one day ?

Kath Younger says

Yeah I totally agree it is skewed towards people who would have the time or desire to read a blog like mine. Wishing you guys best of luck in your debt payoff journey!

Sarah says

I see money from so many different perspectives. My husband and I have been frugal and strategic and I’m proud of our decision making—we have been able to fund grad school twice without loans, have me work only part time to be with our kids, adopt, buy cars in cash, be debt free except our mortgage, and do some other things that may look challenging on paper with our salaries. But at the same time—my family paid for my undergrad education and his parents paid for half of his, and we bought our house with a down payment left to me by a deceased grandparent. If we hadn’t had those legs up, we would be in a different situation. We have also taken opportunities that were available to us along the way (scholarship for one of our daughters for specialized school she needed, discounted gym membership when we were in grad school, hand me downs, etc.) without shame (especially because we also maintain charitable contributions no matter our income level). I would say we are where we are because of generosity AND discipline, and as such we maintain a strong value of giving back and making sure we are actively using our privilege to give back. I think people in the FIRE community can sometimes appear a little too self focused (not saying you are like this at all! Just making a generalization) and it makes me feel a little icky if the sole goal is freedom/independence. We are made to be somewhat interdependent IMO! So I like it when people frame that conversation more around legacy and generosity. It’s certainly much easier to be exceedingly generous when you have financial room to spare! Just some thoughts…

Kath Younger says

Love your thoughts and agree with a lot of them.

bonnie says

I’m 56 and FIRE’d last year and my husband will retire in a few weeks, at 53. Our goal was for both of us to retire around age 55, so we met/exceeded that by consistently living beneath our means … it looks like we’re in the 25% or so in your survey not earning $100K+ . The spending philosophy that works for us is to save a lot, while still enjoying experiences that we love – dining out on occasion, concerts and plays, vacations, hobbies, three pets, etc. We spend on what really matters to us. Eating healthy vegan meals is an area we consider important, so I work to balance cooking with cost-saving ingredients like dry beans with more expensive options such as an Impossible Burger night at home now and then.

The book, “Love People, Use Things” has great insight for those wanting to get off the buying THINGS carousel as well as to eliminate “stuff”.. For us, really thinking about what we spend our money on, and how long we worked to earn that money (granted, our income is less so items seem more impactful to our budget) was eye-opening.

I hear many privileged young couples talking about wanting a “dream home” … skip that and work toward what you consider your “dream life” if you feel you need to chase something down. If you’re looking at a home that is truly bigger than you NEED, you have to heat/cool that home, property taxes are often higher, you often buy more things to fill it that you otherwise wouldn’t have bought, higher insurance costs, more to clean/less time available to do things you want to do, higher repair and maintenance bills, maybe more landscaping done to “fit” into the neighborhood, etc. That one purchase will impact your spending every single year. We live in a smaller home, and while coworkers were getting raises and moving into larger homes, we stayed put … now they’re asking each of us HOW are you retiring 10 years before I can – We made about the same amount!? Would I have wanted a larger home? Probably, at times. But that wasn’t the answer for us, plus we like being near each other 🙂

Kath Younger says

Congrats on FIRE-ing!! You are not wrong at all about your house comments, but remember the main difference is margin. So long as the people who get the bigger house still have a good savings rate, we do need to remember that personal finance is personal. I think we probably agree that what’s important is that spending is done with intentionality and focus. Some people value a big house but couldn’t care less about clothes or cars; others might want a smaller house so they can dine out and travel. It’s all in what you value.

bonnie says

Absolutely – we all spend on what we think is important. I just think it’s interesting that among our coworkers/friends who consistently upsized their home through the years, to now wonder why they’re more than a decade off of financially being able to retire, is it eye-opening. Awareness is the key, as well as consideration of long-term expenses.

I spend on things that others would definitely think are a waste of money – three pets’ food, vet bills, (insulin 2x day for one cat), paying for pet sitting when we travel, etc. That’s thousands annually that another family may think is absurd. 🙂 But for us, the companionship they provide is worth it. Probably more to me than my husband 🙂

Kath Younger says

Totally. And those people who are complaining and confused need a little education : ) That’s the problem – we need to teach personal finance in high schools!

Angie says

Our school district just surveyed the parents and asked if they should require 1/2 credit personal finance class for HS graduation, and I said YES!!

Kath Younger says

YAY!

Laura says

I love this stuff, too! It’s always interesting to get a peek behind the curtain. Have you ever read the “Money Diaries” on Refinery29? https://www.refinery29.com/en-us/money-diary It’s fascinating to see what people earn and what they spend their money on (and how many people — to me, a big time saver who often toes the line between frugal and cheap — seem like they are frivolous with some of their spending).

(Unrelated to this post — A head’s up that I’m commenting from my laptop and the font in the “Leave a Reply” field is very small — like, 8 pt font maybe? – and very light gray. It’s hard to read what I am typing. 🙂 ).

Kath Younger says

I have read a few of those – yes!! Sometimes I think they are embellished, but maybe not!?!

And thanks for the tech feedback. What browser are you using? I just checked Chrome, Safari and mobile and it’s black and normal looking sized for me.

Kelsey says

Mine is the same! I’m on Chrome. Light grey and very small font size 🙂

And I love the Money Diaries! There’s also a Reddit forum where people can submit the same thing.

Kath Younger says

Can one of you please email me a screenshot!? Katheats at Gmail. Thannnks!

Maria says

This is a cool post! I’ve also been interested in FIRE for a couple of years now and listen to lots of FIRE-related podcasts. As somebody who also loves episodes that talk with real people about their finances, I would have loved to see YOUR answers to these questions, at least the ones that aren’t dollar-specific for privacy 🙂

Kath Younger says

Haha!

So I have 4 people in my household, 39 years old, 2 incomes. We own our home. Have monthly budget that I meticulously track! Don’t have debt besides our mortgage. We both contribute to retirement accounts. Savings rate over 25%. Struggle with spending way too much money on food!

Marina says

Haha – thanks Kath!! 🙂

Kathryn says

Never got your survey

55

no debt wat so ever

Shop at ethical companies who do not experiment on animals

Rarely eat out and that saves lots of money

K~

Kath Younger says

Thanks for chiming in!

Ella says

really interesting read! I’m 23, about to graduate with my bachelor’s degree with no debt (which I am SO grateful for). I just wish that things like budgeting and understanding money was taught in school. I feel like everyone is just on their own in figuring it out themselves. I’m really lucky to have parents who a) paid for my college and b) actually understand and value teaching me things about money, but it really needs to be across the board, standard education IMO. My boyfriend was raised in the foster care system for most of his K-12 life and no one ever took the time to teach him things like even the most basic of budgeting techniques. Seems like a fatal flaw in our education system!

Kath Younger says

100% agree. This is why I love podcasts – so much to learn and they are free but you do have to seek them out (so are library books but those are harder to sit and focus on IMO).

Angie says

This is very interesting to read. Everyone’s story is different and personal. I’m married, and we’re both in our 50s with 4 kids. 2 are in college and 2 at home. We were fortunate to buy a house early in our marriage that we’ve been able to add onto instead of having to try to move in an expensive metro area. We are on the high end of the salary range and are very fortunate to have very little debt. Paying for college for 4 kids has kept me up at night in the past, but we just made the last payment for kid #1 and seem to have a savings plan that will get all 4 through. And we’ve saved for retirement all along. I budget like a maniac, and we are pretty frugal, except for food and wine!