I consider the day I graduated from college to be the day I officially became an adult. Until then I had lived in my parents’ house or dorm rooms and had never been financially responsible for all aspects of my life. Sure, I’d had summer jobs and learned about spending and saving. I’d heard “Thou shalt save money,” “Saving for retirement is especially effective when you’re young,” and “Don’t spend more than you earn,” but I had yet to see any of it in action or apply it to my own life.

The year I graduated, Matt and I moved into an apartment together in Charlotte – just south of where we went to school in Davidson. After a lot of job searching and a little luck, I landed my first job as assistant editor at Charlotte’s hospitality magazine: TRIP.

I think my starting salary was less than $20,000 (luckily I got a raise later that year!) Matt had had a harder time networking for a job and was commuting back up to Davidson to continue at the restaurant where he worked in college. He eventually got a job selling different kinds of insurance to seniors, which he kept for a few years. But his income was never steady.

Back in those days, I really don’t even remember how we managed our money. Luckily our apartment’s rent was only about $600 a month, and we didn’t have cable (or even a TV for a long time!), smart phones, furniture (hello frat couch!), a beer brewing hobby or any of the other little luxuries that we’ve accumulated over the years, so our expenses were very low. We paid our bills and monitored our cash flow, but I don’t remember ever really having a plan. I just knew I wasn’t allowed to spend more than I earned.

The following year, I transitioned into a job in public relations with a higher salary, better benefits and more potential to move up.

[Side note: I used to do PR for Bojangles and made biscuits there one morning for an event!]

Matt continued to work in sales. We saved. Eventually we got married..

.. and we bought a house (I’ll disclose here that we did have help with the down payment – we did not save it all ourselves).

We never spent more than we earned, so we didn’t have much of a need to set up a strict budget. I remember a few spreadsheets I created and a phase I went through with Quicken, but both attempts at money management were too tedious to maintain.

It wasn’t until I went back to school and Matt lost his job that we really had a need to buckle down and budget.

Times were tight and we had to get serious about our cash flow. We’d been successful saving, but our spending was out of control. Around this time I started KERF and a bit later had a small stream of [unpredictable] advertising income. Matt also started working at Great Harvest and EarthFare grocery store – working 80 hours a week and one time 35 days straight without a day off. He was happy though, finally doing something he really enjoyed. There were moments during this time when I really didn’t know what was going on with our cash flow – and that really scared me. It was time to get serious and create a system. Something I could rely on and something simple.

It’s taken me many versions tweaking our budget to really make it work for us, but during this time we’ve been able to save and save and save. I finally feel like I’ve become a responsible adult who knows exactly where, when, why and how all our money goes where it goes. Organizing our finances has been so liberating!

We have three tiers that we use to manage our money: a website, a spreadsheet and a smartphone app. Each is equally as important to making the system work.

Tier I: Mint.com

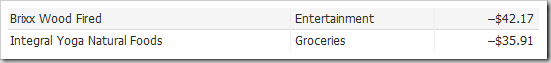

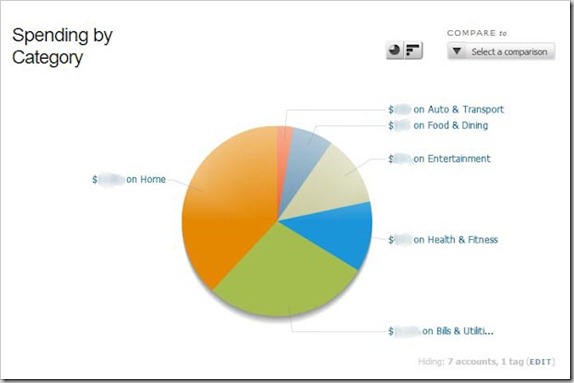

Mint.com is my dollar savior and saver! We have been using it since 2008 and as a result, I can see in a snapshot where we spend our money. Mint is linked to our checking, savings, retirement and investment accounts so I can always know in a second where everything stands. [Mint is super safe and secure so I have no qualms using it.]

The key to making Mint work for me was to SIMPLIFY (there’s that Home Neat Home theme word again!) the categories. Who cares if you spend money on bars or coffees hops or books or clothes – I need to know if my money is going to something we WANT verses something we NEED. That’s really all that matters to me. There is some gray area, but in general, I just like to see living expenses, need expenses and want expenses. Therefore, my Mint pie only has the following categories that I force all transactions to fit into: Rent, Bills, Auto, Groceries, and Entertainment.

Easy as pie!

These match the categories in my budget spreadsheet below for easy comparison and reconciliation! Sometimes I do have an extra category for special occasions, like my biannual dentist appointment as you see in the pie above as “Health And Fitness”, but I just add those in as necessary and they are easy to manage and spot.

Tier II: The Spreadsheet

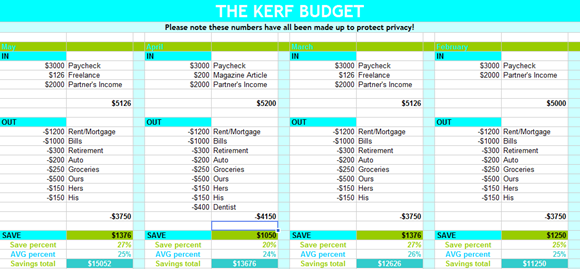

[Please note all the numbers in this post are completely made up!]

I spend hours looking at our spreadsheet, tweaking things, changing the colors, creating formulas. It’s so fun! And it’s really not all that complicated to create.

Here is a link to the public Google doc so you can copy and paste it into your own spreadsheet!

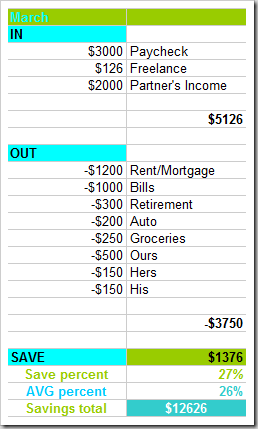

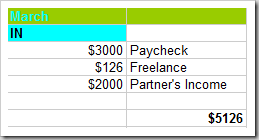

There are 3 main categories: income, expenses, savings.

The income section goes on top and it calculates how much income we have. Everything from paychecks to freelance work to reimbursements. In our freelance-based house, this number is variable, so it’s very important for me to project what we think we’re going to bring in each month here. Sometimes it’s less, sometimes more, so I do always try to guess conservatively. At the end of the section there’s a simple sum formula to total income.

[I also have a fancy formula to then calculate a percentage to deduct for taxes and finally come up with a net income that I’ve removed from this to make it easier to understand, but don’t worry about that if you’re not self employed!]

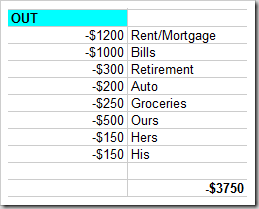

Out totals expenses. Nifty, huh?

Our line items include the same pie charts in Mint (simplify!) Rent, Bills (which breaks down into about 15 items), Retirement (a non-negotiable expense! This isn’t included in the Mint pie chart it’s technically a transfer not an expense), Auto, Groceries, and 3 spending allowances, His, Hers and Ours. At the end of the month I compare Mint to my spreadsheet. Hopefully we come in under, but if we’re over on something I adjust it and then adjust the amount to transfer to savings.

For the His + Hers spending allowances, we decide on a dollar amount to give ourselves each month for frivolous spending, aka accessories and beer equipment. The number goes up or down depending on how much income we have and savings goals. If savings is not over 20%, we lose our frivolous spending money. If savings are well over 20%, we might get a “raise.” In the above example, I set the allowance at $150/mo.

In our household we each have a personal checking account that is 100% our own. We transfer our allowances into these accounts and can save or spend them individually with no strings attached. This has made money + marriage conflict free! I never care when Matt buys beer supplies because I know he has “earned” the money. Same with me and a pedicure or new outfit. It’s spending we don’t ever feel guilty about.

Lastly we have the “Entertainment” allowance (= Ours), which is everything unexpected as well as everything we do together as a couple. Dining out in restaurants is given the same priority as a new bath mat for the bathroom and toilet paper which is the same priority as a wedding gift for friends. A really big unexpected purchase might bypass the monthly budget or come out of savings or get its own category in mint, so Entertainment is really for more normal things.

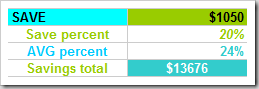

At the very bottom, the leftovers are the savings. But they really aren’t just “leftovers” since I adjust the expenses to make sure this number is high enough. I have formulas that calculate percentages and try to stay above 20% – sometimes we’re more, other months with something unexpected we might be less. But the average percent is what we look to keep as high as possible. The Savings Total should match the balance we have in our savings account. I have this on the spreadsheet because it’s so motivating to see it go up if I make our OUT section go down or IN section go up!

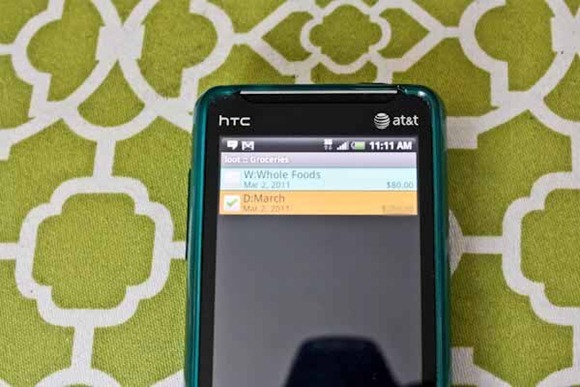

Tier III: Loot + Spend Apps

We manager our His, Hers and Ours allowances using our smart phones! You really could just use a little notebook or keep track of receipts and enter them into another part of your spreadsheet, but I find that entering them on the spot when I’m out spending is most effective.

There are two apps that we use to do this. At the beginning of each month, we enter our allowances into the app and enter transactions as they occur. I’m in charge of Hers and Ours because I’m the more organized nerd of the two of us and usually the one buying things like toilet paper too. I also have an allowance for Groceries in my phone – which I set to$250 each month. My favorite of the two apps is for iPhone only (or at least it was when I got my Droid last summer). It’s called Spend. It’s got a cleaner look and I like the way you can have it show either the amount spent or the amount left in any budget.

The Droid app I like the most (and trust me – I tested a LOT of them!) is called Loot. I bought the premium version for $3 or so to be able to customize the colors and a few more things 🙂 It essentially works the same as spend – you set a budget and enter in transactions. It’s a bit more advanced, but advanced is often the opposite of simplify and I prefer Spend’s simplified look.

Entering in a transaction in Groceries:

Both are great though! At the end of the month I reconcile the allowances with what we’ve spent in Mint.

One more thing to note: when I get out cash from the bank, I consider it spent. So I’ll put a line in my allowance called “cash for FL trip” and if I spend the $40 cash while I’m there I really don’t care how I spent it – I know that it was pretty much all non-essential spending, which is the only detail I care about! Another small mental thing I love about the way I do cash is that when I eventually do spend it it feels like free money. Maybe the experts would like that, but it’s a little perk in my day to buy a coffee guilt free because I have some cash and it’s already been accounted for.

A Penny For Your Thoughts

So once you have everything all organized and set up, the only daily/weekly maintenance this whole system requires is at the smart phone level – keeping track of purchases as they come through. So long as you have a cooperative partner, you can make this work. At the end of the month I transfer out our savings, retirement, taxes and upcoming month’s allowances and make sure the upcoming month’s budget looks like an accurate prediction.

I’m always tweaking how I do things. You can watch a whole video of a previous version of the NERD KERF Budget demo in this video. I only changed the order of operations in allowances vs. savings from then to now, but the basics are the same.

I definitely don’t have all of the answer>s. What’s most important is that you know where your money goes. Having an organized budget won’t fix problems and it won’t always make you happy when you realize you have no discretionary spending for the upcoming month. But it will allow you to make adjustments and hopefully build your nest egg with better awareness of dollars and dimes.

Cait @ A Bicycle Built for Two says

LOVE this post-so helpful. My husband and I use mint.com also and love it! Thanks for the helpful advice 🙂

Bronwyn Coyne says

That’s awesome. Budgeting is something I think about more and more as I’m getting close to finish up my degree. Enter real world and income, I’ll definitely need to work on the savings game.

Lisa Fine says

Loved reading about your methods for budgeting. My partner and I love sitting down at the end of each month to tally our expenses and savings, and we track all of our expenses, and have been doing so for years. We’ve been able to save a lot of money, and it allows us to have money for the things we love, like travel and eating lots of organic and local foods.

Sarah @ The Strength of Faith says

Great post! I think one of the most important money-managing tip I have is to talk talk talk. When my husband and I moved in together, I took over all of our money management. Eventually I realized that it was too stressful for me to be the only one working with money and not good for him to not know what our situation is. It’s taken time – and we’re not there yet! – but we’re starting to learn how to speak the money language.

Jacie says

Do any of those apps help with potential tax deductions such as health insurance premiums or charitable donations?

As a side note, does Great Harvest help you provide benefits for your employees?

Thanks.

KathEats says

I don’t know about the apps…not sure what you mean?

GH employee benefits are entirely up to each owner

Amy says

I hate to say it but this whole post went over my head.

I used mint.com for a few months several years ago, but it would send me warning emails every time my account balance was under $200. At the time I made very little money – a $200 account balance was golden to me! It made me depressed so I closed it. 🙂

Alexis says

You can change that setting now! I actually like some of the alerts as they make me feel a little guilty of I go over a budget item — you can shut all alerts off though. I’m obsessed with mint.

gabriella @ embracement says

Kath, I totally and completely love this post. I just glanced it over at work and will be thoroughly reading it when I’m out. I am a money saver, hoarder, cheap-o and I love finding new programs to use to organize my budget. To me it’s the easiest, best way to save and not go crazy if everything is organized and easy to see.

J3nn (Jenn's Menu and Lifestyle Blog) says

Great organization! I can relate. When Dustin and I first lived together and got married, we never spent more than we made, BUT we were terrible at saving! It’s taken us several years of practice to make savings a priority; now we treat it as another bill, as if it’s mandatory. And I believe it is, especially when you are self-employed!

I have the same cell phone! We got the HTC after our iPhone.

Natalia - a side of simple says

With graduation coming up in May, I am DEFINITELY bookmarking this post!

Love the picture of you and Matt from your wedding, so lovely.

Christie {Nourishing Eats} says

Wow, what a thorough post on budgeting and tracking. We still don’t have a great system, my husband keeps a huge spreadsheet that I don’t understand. I have tried a few systems and we don’t seem to both understand the same ways which I think makes it harder. I like the idea of the his and hers spending. We should probably think of doing something like that.

Leanne says

Love this post 🙂 I already do a lot of the things you mentioned. I find budgetting fun too so I’m a nerd I guess as well!

Nancy-The Wife of a Dairyman says

I love this post also. It’s great to hear about droid apps that are useful! As for budgeting…we don’t have one, but maybe I need to get one started. As dairy farmers and like most dairy farmers, we haven’t been making profits in the last couple of years, so we don’t spend a whole lot anyway, although having a budget may help the guilt felt when spending on things such as T-Ball, soccer and gymnastics for the kids:) {because those things are ‘extra’} Thanks for the info!

Natalie @ Will Jog For Food says

Great post! Mint is something I need to check out for sure. While my husband and I have been relatively good at saving money (except for some weekends when we splurge too much), it would be great to keep better track of everything. We created a budget when we got married, but haven’t looked at it since.

Amanda says

YES! Thank you so much Kath this is awesome! I loved your nerd Kerf video on this subject and I created my own system based on it. Before I was just saving as much as possible and felt so guilty when I spent ANY money on things like going out to eat or clothes, having an allowance is a great idea and gives me a little “play” money while still meeting my saving goals! Definitely going to go through this post more closely over the weekend while I organize my office, thank you, thank you!!

Amanda says

i’m just a college kid and i’m so stressed out about it!!! you seem to have it all under control, such a good role model!

Anna @ Newlywed, Newly Veg says

Wow– awesome post!!! Thanks for sharing so much info about your number crunching– you seem to really have it under control!

It’s funny to think about both you and Matt having “traditional” jobs at one point 🙂

Des says

Very inspiring post. This is something we should all strive do! Thanks Kath!

Alaina says

What a great post! With my husband being gone for a year I have to really budget and try to save so we can build a house when he gets home. 🙂

Leah says

I love http://www.doughhound.com/ you should try it! Its free and you don’t have to give your credit card info!!!

KathEats says

I will definitely check that out!

Annette @ EnjoyYourHealthyLife says

What a fabulous post-SO very helpful, Kath! We’ll be using this as we too are getting all finances in order. Good work 🙂

Kristi says

KATH!!!!! I get my first GH experience TODAY! My mother is coming to visit and is going 25-35 minutes out of her way (4 hour drive) to get me some!!!

I know for sure the Reuben bread and sourdough bread. Unfortunately they do not have Dakota Bread on Thursdays…what I was really hoping for!!!

Anyways, IM EXCITED!!!!!

holly @ couchpotatoathlete says

I loved this post Kath! My post this morning was about Jason and I paying off tons of credit card debt — and it all happened because we budgeted well each month.

I love Mint.com — it is so helpful in tracking expenses.

Cassie @ Back to Her Roots says

I was SO excited for this post because I thought I’d learn something new, but really, I just learned that we are doing it right. Which may even be something better to learn than something new! Woohoo!! We use Clear Checkbook for our check register and spending limits (it has apps available for both of our smart phones) and we have one hefty Excel document for budgeting.

I love, love, love formulas. 🙂

chelsey @ clean eating chelsey says

Love seeing how others finance their money! My Husband is the brains in the finance department in our house, but we somehow have it down to a science even though he doesn’t get a “real” income since he is a small business owner!

Allison @ Happy Tales says

Kath, this advice is soooo valuable!!! THANK YOU for putting this together! I completely feel the same as you… I feel that my first day as living as an “adult” was the day I graduated college!(Funny… I moved to Charlotte the VERY next day after graduation (from furman tho, not davidson!) too!) Hopefully I’ll be where you are one day. I’m currently in graduate school and working part-time (only bringing home just over $500/month… so I am on the *tighest* budget EVER!!!) My budget just barely covers my montly rent/auto/and bills. I’m on foodstamps, so that helps with the food part… but establishing yourself as an adult while still in school is SO tough!

Emily says

Wow- I NEEDED this post!

val @ lots of dishes says

this is my absolute favorite blog post. i have always been a super saver/budgeter and my live-in boyfriend and i have been really into a show on CNBC called “til debt do us part” where they show couples in trouble with money and the host puts them on a budget of cash spending only (for non-fixed bills) (info here:http://www.gailvazoxlade.com/articles/budgeting/magic_jars.html).

however, there is no “his” or “hers” or “ours” portion on that program, and i LOVE that idea. i’m going to use it FOR SURE. thank you!!!

Katie says

Kath, thank you so much for posting about finances/managing money. My husband and I are just starting out on the long road to budgeting for the future, and I feel like you wrote this just for us! I love how organized and simple it all seems and I hope to take better control of our spending and saving habits from here on out.

sarah (the SHU box) says

just had to say: BEST! POST! EVER!!!

🙂

Josie @ Skinny Way Of Life says

Thank you for taking the time to post this! My hubby and I met in college and lived together for awhile before we got married. We never lived on credit but were young and would spend way to much instead of save. We’re both young (25 and 28) and we now have 2 young kids, we try to save as much as we can but it’s very difficult with a home, pets and kids. I’ve been looking for awhile for a new budgeting system- call me old fashioned but I still use the envelope system!!- I’m off to go look at mint.com and the loot app, thanks so much!

Angela @ Eat Spin Run Repeat says

WOW Kath, this is one of the best posts (and definitely the most useful!) that I’ve read all day! Firstly, I LOVE your wedding dress! And thank you so much for talking about the system you and Matt have in place – you’ve inspired me to do something similar. 🙂

Ingrid says

Kath,

I think I need to talk to your mother. I want to know how did she do to raise such an organized, level-headed girl like you. I am always in owe!

KathEats says

Ha! I think it’s because I’m the first child = type A!

Ingrid says

Kath, I’m the first child too and I’m, unfortunately, not nearly as organized as you are. I am reading your blog everyday though and I hope that it will rub on me!

Mom says

Ingrid,

Why thank you! She and her dad aren’t going to give me that much credit, but I’m a lot more organized than they think I am.

KathEats says

HAHA!

Ingrid says

Kath’s Mom,

You did an excellent job!

Ingrid says

Awe!

Flo says

Brilliant and informative advice as ever Kath! As a technophobe I shall tentatively try and work out if any of the three work here in the UK! Wish me luck x

Alison says

Thanks for the post Kath! It was so helpful and just what I’ve been looking for!

Caitlin says

I love this! I’ve been working on a budget myself too–and this helps so much! I’m fresh out of school, but can definitely relate to this! Thanks Kath!

Heather says

wow info overload! It looks awesome though. I have played around with mint a little.

My husband used to be self employed so it was so hard to “budget” b/c we never knew how much he was going to make!

Jill says

Hi – random question: in your older posts, you reference a frequently asked Q and A’s section on your website – does that still exist? I can’t seem to find it 🙂

KathEats says

It’s no longer up. It was out of date, so I removed it and didn’t feel the need to re write

Bridgette says

This post just made my week!!! I read your blog all the time and love it, but this post just really goes well with my life right now! Graduating college and moving into a house with my boyfriend all while trying to get the money straight. 🙂 Thanks for a great post!

Maria says

I just signed up for Mint.com. I wish I would have known about this website earlier. Thanks for sharing your advice 🙂

Shannon says

You’ve got a great system going…we used to have a spreadsheet system, but we bank with a credit union that allows us to have multiple chequing and savings accounts and there are no fees. So we set everything up in one account – we have one chequing and one savings account we can access on our debit cards and the chequing holds our grocery money and the savings our entertainment money. Then we have another chequing account for all of our direct debit bills. We have something like 15 savings accounts – regular savings, special things (trips, large purchases, etc) and bills. Things like our insurance and property taxes that we pay once a year have their own account that we contribute to monthly so the money is there when the time comes.

Other things like our hydro bill are bi-monthly and fluctuate over the course of the year…we averaged the first year we were in our place out over twelve months so when we get those heart dropping bills in the middle of winter the extra money we put away in the middle of summer takes care of the “I think I’m going to puke” factor!

When we use our credit cards, we try to immediately transfer the money to the appropriate savings account from the budget category – for instance the debit machines weren’t working at the grocery store the other day, so when I got home, I transferred the amount I had spent from the grocery account to a savings account for when we get the credit card bill.

We also have a monthly allowances and our own chequing and savings accounts and it was the best thing we could have done. No arguing over who had coffee out six times this week or who bought new cds or shoes or whatever. It allows us to keep our own hobbies and interests without worrying about impacting our grocery bill or savings or other household expenses.

I like your spreadsheet – it’s much simpler than ours was…I might be convinced to start one again! Thanks!

Lorena says

I love this post! Thank you for all the info. I’d love to also find out what your grocery shopping strategy is to stay within budget. Thanks again. I love your blog.

Laurie says

Just one question…is toilet paper really in the entertainment category? 🙂

KathEats says

Ha – yes!! Because I’d rather it go under Entertainment than Food- I need all the food money I can get!

larissa h says

is this what happens with some of the other stuff that arent bought too often, like shampoo face wash etc? thanks so much for this post, i bookmarked and showed it to my boyfriend as we recently were talking about how to do a joint and separate bank accounts (as we heard from many that it is the secret to a good marriage but we didn’t really get how it worked!)

JJ says

Yep… You are definitely type A!! Sounds like your married your opposite!? The best match in the world!

Mary says

I have a recommendation for those who have a predictable regular income: set up automatic transfers to savings so you don’t even see or have all of your income at your disposal. You can easily set this up through your bank. Check with your employer, too. Mine offers to direct deposit a percentage or amount – of my choice – from each of my paychecks to either checking or savings accounts.

Kind of an out of sight, out of mind concept.

It’s easy, and the money adds up QUICK.

Averie (LoveVeggiesAndYoga) says

Posts about saving money and getting out of debt, taxes, etc seem really popular this week! I have seen a couple and it’s so inspiring.

I posted a couple days ago that I just became Debt FREE! I paid off all my credit card debt, no loans or money owed to anyone. I am debt free. And it felt amazing to write that post.

I also have saved money. It was one of my 2011 Intentions, i.e. New Years resolutions, to pay off my debt and save money and after years in the making, both things have happened and the saving is an on-going process.

Thank you for sharing what you did, Kath, and for talking about money, tips, and for your honesty. It is so helpful! 🙂

KathEats says

Congrats!!

Stacy R. says

I can’t wait to get to that point Averie! My big question is when you are paying off debt do you save a little as well, because it’s good to have some extra cash when unexpected things come up, but I feel like I should be putting ALL extra money into my debt. sigh……this year is my year to pay everything OFF!

Averie (LoveVeggiesAndYoga) says

Well for me, I was saving a tiny amount each month while putting my focused effort into paying off my credit card debt as fast as possible b/c the interest rate on the c.c. debt was much higher than what I was getting from savings. So that was how I worked it for my own personal situation.

I used to have money saved and no c.c. debt, then I entered a bad real estate decision and things went south from there. The post is on my site, feel free to pop over and read it. But good luck getting out of your debt, too!

Cathy says

Dave Ramsey loves people like you!!! Congratulations…:)

dee says

i cannot say how much this series is helping me right now. thanks so much for taking the time out and doing this kath! i know i’m not the only one who really appreciates it!

Jo says

In the first pic (graduation), who’s the guy in the middle?

KathEats says

One of our favorite profs!

Jo says

WOW, he is so young, I can’t believe he’s a professor! Nice to have profs on the younger side, I think.

Amanda (Eating Up) says

This post is great. I’m about to graduate and manage my expenses for the first time too, and this will really help me!

KatieTX says

Great post! I love budgeting. You are the one that introduced me to Mint about 1.5 years ago. I love it! My fiancé and I are about to both have steady (and luckily, high paying) incomes. I am making us a strict budget so we can SAVE as much money as possible! It is interesting how everyone does their own budgeting. I like having mine broken down into very specific categories like Mint does it. I do like how you tweaked Mint though to work for you. I may do some tweaking of my own. Thanks for the great advice!

Melomeals: Vegan for $3.33 a Day says

I am the most frugal person I know and now that I am not married, I know my spending down to the penny and LOVE budgets and numbers. This post made me get all nerdy happy.

You are very lucky to be married to someone who shares your views on money. Mine didn’t and it was a very stressful part of our relationship due to my NEED to KNOW exactly where my money is going.

Cat says

Thanks for the inspiration! I’m self-employed and have been dreading doing my taxes for the past few weeks and this post just gave a little boost to get cracking on some much needed budgeting!

Mary says

Hello!

Love this post, but have one question…is your grocery budget really only $250? I eat a very similar diet to yours, but find it difficult keeping my grocery bills under $350 a month. And that is with a husband who prefers to eat out at breakfast and lunch during the week and dinners on the weekends (he has a very social job where bringing his lunch just isn’t an option).

Also, I love your His, Hers, and ours category! I have a difficult time getting my husband to pay attention to where he spends his money, so we are now using a strict cash system. We each get $100 at the begining of the week. He no longer has to ask me if he can pick up food on his way home, he just has to look in his wallet to see what is left!

KathEats says

I changed all the numbers for privacy’s sake, but we do usually keep our groceries under $250. It’s hard – and that number does not include toilet paper and things that are not food. But we do it. Some months were at $225 and others $275, but we haven’t been above $300 in years. We only buy what we absolutely need!

Bree says

I totally fail at this. I’d like to learn more about how you do grocery budgeting in and of itself!

Jack O'Brien says

Do you use coupons to save money on your groceries or do you find that it only really gets you to buy in excess and things that you wouldn’t use normally? I started coupon-ing my last year at college and it DRASTICALLY helped me save money.

KathEats says

Actually one of my secrets is to not buy things in packages – which most coupons are for. I usually clip dairy and sometimes chips/crackers, but most of our purchases are produce and bulk bins with bits of meat, cheese, nuts in there.

Liz says

$250? For the MONTH? Holy wow. I spend at least $300 a month for just me and my live-in fiance, and I would love to cut that down. Would you consider maybe doing a “smart shopping” post?

Cathy says

THis is awesome….has the food budget changed? I see you shop at WF quite often. With my $$ I can only purchase a treat every now and then. I usually shop at HEB or Kroger.

KathEats says

Nope, it’s the same. We came in at about $50 for July and $250 for August!

Cathy says

Wow….so I shld be purchasing at the farmers market & I can buy things at WF. 🙂 Do you ever throw food out? Do you make a grocery list or menu? I am curious. This is so wonderful!! You eat healthy and dont spend much $$.

KathEats says

I just get the bare minimum that we need, so no, we rarely throw anything away. We also don’t eat a ton of meat, get our bread for free, and Matt eats lunch at the bakery, so that all contributes. And my budget does not include eating out!

Cathy says

Kath this helps me alot!! I am tellling my co-worker. 🙂 Have an awesome Labor Day!!

Meredith (Pursuing Balance) says

I really loved this post! One question though — you mentioned that you and Matt each have your own bank account for “his” and “hers” — do you also have a joint account for “ours”? And if so, how do you decide what goes in it? Is it a percentage based on how much money you each make?? thanks!

KathEats says

Good question! We do have joint checking, savings, and investment accounts. I believe that all money that comes in our door (with the exception of birthday checks) should go to our family. I don’t care if I’m making $5,000 a month and Matt is making zero (which is not all that far from our current situation!) I don’t believe in splitting up the money. Everything in our marriage is as equal as can be. So rather than our incomes coming into our personal accounts and “donating” to a joint account for household expenses, everything goes into our joint account and we transfer OUT personal spending money.

Alison says

I really like your ‘family’ approach and it’s exactly how my husband and I approach our finances. Except, right now I’m a stay at home mom and therefore make zilch. 🙂

Susan says

The BF and I do this as well. We each get the same amount each month for personal expenses, too. I did try to get him to use my fancy eye cream so it could be considered a joint purchase, but he wasn’t going for it.

Baking 'n' Books says

Excuse this if it’s too personal – but is there any conflict or ill feelings if one of you do provide more money for your family?? (more pressure for the other person). I’ve had friends who have made more than their significant other and it brought some tension. However in that case the other person really wasn’t putting much effort into work. Which I don’t think is the case with either of you guys!

KathEats says

Not at all – so long as we’re working towards success

Hope says

I love this post! You are so organized! I really need to get into the habit of being organized with my finances. I have an absurd amount of student loan debt which the majority of my paycheck goes to. I feel like I will never get out of debt but I know there is hope. It’s really hard to save when I’m not making that much but I think things would be much clearer if I used your chart and organized everything. Thanks for writing such a great post! 🙂

JJ says

The secret to having strong finances is tithing……It’s a Godly command….and it really works!

Read Malachi chapter 3:6-12…..the choice is yours…

Kris says

Amazing that you were able to save up to open your bakery while you were in school. Great job!

kate@ahealthypassion says

What a great post soo informative. Budgets are so important im already thinking about putting one together for when I graduate!

Buddhette (Young Buddha Ate Rice) says

Hey Kath,

fantastic post! Thank you for posting the link to that spreadsheet. That is going to be so helpful! I am completely inept when it comes to Excel, so this just made my day! You’re awesome!

Stacey (The Home-Cooked Vegan) says

I agree! It’s so important to know where your money goes. When I was a college student, I used to spend and spend, living paycheck to paycheck and never saving. Luckily, I met my financial guru of-a-boyfriend and he has taught me so much about the value of money. And what can happen if you save a little!

Mary @ Bites and Bliss says

I’m saving this..it’ll probably be years before I need it as I’m still in college and all..but I’m saving this, such great tips!! I’m so glad you and Matt were able to work it all out, too.

Summer says

Thank you for this great post! My husband and I have also had to tighten our budget significantly, so it’s nice to feel like we’re not alone. Over the months, we have found many simple ways to save a good deal of money. One of the easiest has been bringing our lunches to work. We both received Laptop Lunches bento sets for Christmas and they have made bringing lunch to work so easy that we don’t even miss eating out. We also bring them out on weekend trips. You should check them out, www.laptoplunches.com.

K @ Anywhere There's An Airport says

I loved this! I work in finance which at time can be so complicated. But my personal finances and personal spreadsheets mirror yours almost exactly! Proper money management can be so simple!

Christina says

Thanks for this post! I love the ideas. I’m always tweaking my budget process. You have a couple ideas that I’m going to try incorporating.

Laura @ Sprint 2 the Table says

How much time do you invest in tracking this monthly? It seems so overwhelming to me!

You guys spend under $300 a month on food?! I can’t spend less than that in 2 weeks and it’s just me! Can you please post a “how to” for that amazing feat?! 🙂

KathEats says

Search for “The Thanksgiving Challenge” on KERF – I managed to spend only $126 in November 2008. That was when we were really tightening our belts 🙂

KathEats says

Oh and time, not too much! I spent more because I like to fiddle with it, but you could spend 1 hour per month predicting and transferring and then just enter in on your smart phone or note book as transactions occur that are part of His/Hers/Ours

Susan says

I used to be like that, too, until my BF & I moved in together. I’d go through the store and just buy what I wanted because it sounded good at the time and then it would end up not being used or only partially and I’d throw it away. It happened more than I like to admit.

Do you use all of your food? If you do and can afford it, I don’t think it’s a problem. I could afford it, but I wasn’t using it, so I was basically throwing money away.

Ash @ Good Taste Healthy Me says

ugh I hear you! I hate budgeting and doing spreadsheets. My mom is in the accounting field but I got none of that. No desire for it. Had a couple of snags but for the most part I manage effectively without budgeting.

Angela (the diet book junkie) says

awesome post, thanks SO much for the tips!! you have a beautiful home, btw. 🙂

Julia says

Hi Kath,

Superb post. I will be referencing this again and again I believe!

Question-If you buy toilet paper and cleaning supplies when you are grocery shopping do you then subtract it out of the receipt and put that amount into “Entertainment?” Or do you not bother?

Also, is the house you bought the one you currently live in? I had no idea you owned it. I figured since you guys moved around a bunch that it wasn’t certain how long you would stay in Cville, even though I know it’s a wonderful place to be!

KathEats says

Yes – I split out the household items from food if I buy both at once. I usually food shop at farmer’s markets and whole foods though, so I rarely buy household there anyways

KathEats says

Oh, and we owned our house in Charlotte, NC, but we sold it this past June. We moved to Charlottesville, VA in July and are renting our first year here at least.

RhodeyGirl says

I really want to organize our budgets. We definitely spend less than we make, but I never know exactly much I should be able to save, and I know I am a frivolous spender. My problem is that I’m afraid if I really know where my money goes a. I will be really embarrassed and b. PB might get mad!

When you see it as a whole month at a time it seems that I spend a LOT on girly things (in the summer I get a pedi every 4 weeks) but I feel like I’ve earned the right to have these services. Do you ever wish you didn’t know exactly where every penny goes? Is it a hard adjustment?

I’m on step #1 right now which is learning to manage my grocery budget. I think step #2 will be to straighten out our bank accts. Right now I pay for all house things include repairs but excluding bills + mortgage, and he pays for those things. It kind of works for us but also doesn’t.. It would definitely be more efficient to have our paychecks go to one account and then pay out of that one acct so we can see exactly what we spend.

My only success with my finances aside from saving a certain amount from my paycheck each week is that I have a separate acct just for my investment properties and a separate excel sheet to list all wedding and other special occasion gift expenses…. which add up quickly especially when you consider shower gift, wedding gift, travel to wedding, etc etc

KathEats says

I think having a certain amount dedicated for frivolous spending like pedis is liberating though! Anything I pay for with my personal checking account is guilt free. It’s like money that has already been spent because it’s out of our joint checking and has already been accounted for. It’s made spending much more fun!

RhodeyGirl says

OK I’m going to try that.

Thanks

Susan says

Exactly! When I come home with a new purse or a box shows up on the doorstep, I feel no guilt at all!

Erin @ Big Girl Feats says

This post is awesome. My book club decided we’re going to focus on finance and budgeting for our next book. I think it’s probably equally as important to be responsible in finances as it is health, wellness, etc because you ensure you’re taking care of yourself in all areas! I’ve always ignored it because I felt I wasn’t good at math, but it really has nothing to do with math and everything to do with setting myself up for the future.

Jeni @ stepping out says

Great post! I really need to work on this since I’m going back to school in the fall. I have a Numbers (Apple version of Excell) spreadsheet that I use but I’m not 100% satisfied with it.

I love all of your ideas!

Lauren Christine. says

I’ve been using the KERF google budget spreadsheet since you first posted it! And I must say it has been extremely helpful in balancing my budget. I definitely have saved more money since using it and I can actually see where my money is going each month! Thank you so much for sharing.

Angela (Oh She Glows) says

i think you have finally convinced me to use MINT! I was really concerned about the security but I have heard great things about it from some friends. Im excited to try it out.

Nicole of Raspberry Stethoscope says

Mint didn’t work well for me because some website accounts, like my car loan, and student loans, etc would not hook up with the site, so the whole thing was shot.

suki @ [Super Duper Fantastic] says

Great post! 🙂

anne says

Great post Kath! Love the idea of promoting fiscal responsibility and simplifying. I totally agree that having a budget is liberating!

Marissa says

I really like this post. Having just finished grad school and preparing to move from Ohio to Florida, my husfriend and I don’t have much money. I signed up for Mint and hopefully we can keep track of our expenses better.

Sarah says

Thank you sincerely for this post. I’ve never kept track of what I’ve spent, but I’ve always had something left over in the bank at the end of each month. However, now that I’m thinking about a job transition and generally, you know, BEING AN ADULT, I think it’s high time for a new system. Thank you. Thank you.

Teresa (Teresa Tastes & Travels) says

What a great post! One thing I’ve found to be very useful is that my employer-related AND personal retirement AND personal savings is all taken out of my paycheck before I even get it. I don’t have an entertainment budget – it’s whatever’s leftover at the end of the month because I’ve already saved.

lynn @ the actor's diet says

OMG seriously, is that your rent for your beautiful home?!? i need to move to c-ville….

KathEats says

Nooooo – all numbers have been changed to protect the innocent!

Lauren says

Just a heads up to anyone who has a Wells Fargo (and probably Wachovia) account and using Mint.com, Wells Fargo will freeze your online account! They see the linked accounts has a potential fraud hazard. Despite numerous calls to Wells Fargo to unlock my accounts and explain what I use it for in the end it was just easier to delete Mint. Makes me sad, but oh well.

KathEats says

Oh no!!! That sounds like trouble and I am not happy!

Derek says

I have an iPhone and use the “Balance” app for my income/expense tracking. It’s an incredibly straightforward and simple app. It basically shows a listing of debits vs. credits with a current ‘balance’ amount at the bottom. Some may like the frills of pie charts and budgeting functionality, but this is all I need. Just my 2 cents… =)

Stacy @ LoveDiscoveryGratitude says

Wow, this was an incredibly helpful post! Sites like Mint kind of weird me out, but I’ve heard a lot of people use it, and this post really made me comfortable with it!

Thanks! 😀

Kristine says

Kath,

I want to thank you for the time and effort you put into this post. It is so helpful, and you are so organized! I seriously think you should start up your own organizing company if the great harvest thing doesn’t work out! 🙂

Stephanie @cookinfanatic says

Looks like you’ve found a budgeting method that works wonderfully for you. Lucky for me I’m an accountant so do all this just by nature and have been since college – I somewhat enjoy it, yea I’m weird I know 🙂 Great tips Kath!

Bre says

What a helpful post! As I near graduation and begin to make plans to move to another city with my boyfriend, I have been increasingly concerned with creating and managing a budget successfully… something that is almost totally foreign to me :O Thanks for the tips!

Allison says

Oh my gosh! Thank you so much for this! My husband and I just had an argument this morning about finances and saving. I think these tips and the spreadsheet will be incredibly helpful to us!

sarah (sarah learns) says

wow, kath! my mind is literally spinning with all of this amazing information. thank you so much for taking the time to put together such a detailed and organized post to getting a budget in order! 🙂

i currently have an excel spreadsheet to keep track of each transaction, but it get tedious and little overly detailed, i think. your way looks much more efficient and useful in planning!

The Healthy Apple says

Such a wonderful, detailed post Kath; thank you for sharing this information. You are so organized and sweet to share this with everyone. Hope you are having a great week.

xo

Kristin says

Looks like it rained at your graduation. Did you have it in Baker? Love the budget and finance tips.

Kath says

Yup – rain it was

Erin (Travel, Eat, Repeat) says

I just used your Mint categories to reorganize my Mint.com account and — wow — what a difference! So much easier to have one Entertainment category than multiple Shopping/Eating Out/Home/Metro/etc. categories.

KathEats says

Yay! I agree 🙂

Alison AP says

Kath, I love this! I would love to learn more how manage your food budget for the two of you down to $250 a month. I am just one and I struggle :/

KathEats says

I struggle too! I’m working on a post about it – it’s a hard one to write

SammiJean says

I was also wondering this…especially because you eat so healthy. I know that people argue that healthier options are not more expensive than your basic grocery items, but I beg to differ.

I’m lucky if I spend $250 every two weeks.. and there is only 2 of us! Although, I’m sure we buy plenty of unnecessary stuff. I think that’s my biggest problem – grocery/food shopping. I love food, so I always want everything.

Cathy says

This will be so helpful…I am divorced and just learning to be financially responsible for myself. Thanks Kath.

Christin@purplebirdblog says

Matt looks so super young in those photos! 😀

Chetney (Czesia's Adventures) says

Seriously I REALLY needed this, our budget has just overwhelmed me since getting married in June…THANK YOU!

Baking 'n' Books says

This post is so relevant to me. THANK YOU for taking your time to educate and inform readers…even though I “don’t” want to read it, and it “brings me down” (I have to face the ugly debt I’m in) – it needs to be done.

After years of school and whatnot, I am $130,000 in debt (that doesn’t include my car financing either)….it’s not pleasant. What’s worse? Is that I hate my job and profession. If I had to pay it off but was HAPPY in my work, then it would be much easier to go forth and advance! But I have no passion for it….

Problem is that I can’t just change fields or switch jobs – nothing will pay as well as what I am able to make now as a “Professional”.

Oh, to have a successful blog 😉 – hard work and dedication is where it’s at – BUT that also requires time. With full-time work and freelancing, it’s difficult to follow my passion or try to find out what they are even! Or to develop my own writing and blog….

But the downtime I have needs to be spent making money versus doing things that take a lot of time and may go NOWHERE.

Wheph – sorry, that’s my spiel 😉

(BTW – Matt is so much taller than I thought!)

Erin @ WholesomeRD says

Thank you so much for posting this! We do exactly what you guys do except in Mint we created categories called “Erin” and “Ed” (my husbands name) so that is how we keep track of who spends what. It works for us!

Thanks again for posting this and sharing your budget spreadsheet – it’s so helpful! 🙂

Megan says

I just LOVE the whole HOME NEAT HOME series…. and I’m especially loving the number crunching addition! I loved learning about your livable, conflict-free joint finances practice. I’m a newlywed and looking for a good system – yours sounds great.

Michelle | gold-hearted girl says

That spreadsheet looks totally useful! I’ll definitely fiddle around with it. Congrats on bring where you are now – saving money takes a whole lot of educating and self-restraint!

Emiko says

Thanks so much for sharing these tips! Perhaps I can get some of my finances under control with some of the info I’ve learned here, because I could sure use it!

Tasha says

I agree with all of the above! Really loved this post. And would love to hear your grocery secrets. Unfortunately I rarely have time to read all your posts each day, but lately, when I see the title “Home Neat Home” I get really excited and make sure I remember to read it! (Not that I don’t love your other posts) Keep the series coming =) Thank you!

ashley says

I modeled my budget after yours when you did the first series of videos on YouTube. It’s such a simple thing to do that it’s amazing how fantastic the results I’ve had have been. Instead of my extra money going to who knows what (Really. Where did it go?) before I implemented the change, I’ve managed to pay off 5 (!!!!!) debts since implementing the system back in September. 2 left to go and then it’s time for a roth IRA. Amazing how being aware of spending totally can transform how you go about it. I made 2 additional spreadsheets in addition to your basic finances one. One just sums up monthly totals for the various categories of gas, groceries, his, hers, etc. The other has debt amounts, monthy payments, monthly costs, and how long they will take to pay off given current monthly payment amounts. I love playing with this one, and seeing how much I can up my monthly payment to watch the time it will take to pay off go down. The other BEST thing I did for my finances was online bill pay. Why oh why did I mess around with stamps for so long?

Amy says

Kath, is there a way to simplify MINT like you did? All my transactions are in all sorts of categories! DO I have go over each one individually and change them?

KathEats says

You do have to change them all, but it’s really easy once you get going because Mint will remember. And it’s mostly the Entertainment ones that need changing. You can also rename categories, so you may (i’m not totally sure) be able to just rename all of those Entertainment.

Kat says

I thought that this would be horrible, too, but they have a “change multiple” feature that is FANTASTIC. When you select a single transaction, you’ll see on the right side bar two buttons that are labeled “See All [Vendor]” and “See All [Category].” Click on whichever you want, and it’ll pull up ALL transactions with that label, and you can select them all and click “change multiple.”

SO much easier! 🙂

andrea @ chocolateandoranges says

I love mint too! Although I have all the categories in there, maybe I’ll have to think about whether I really need them. One thing that’s really helped me to control grocery & household spending is a price log. I have ‘best’ and ‘typical’ prices for things I buy regularly so I can make sure I’m not overpaying. I was SHOCKED when I started paying attention to prices at how much they can vary from place to place. I swear the log saves me hundreds!

Christine says

Thats a great idea – I may try this myself!

cameron says

I just took an accounting seminar in grad school and the prof raved about mint- so timely!

Tiffany says

So this is a little creepy, but your budget spreadsheet is almost identical to the one I’ve been using for a few years! I was reading through the post and I came to it and literally yelped. Too funny! Great minds think alike? :-p

And as for frivolous spending, knowing without a shadow of a doubt that all my hard expenses are covered and that this money has been set aside for that purpose, I totally agree, it makes that spending much more fun! Really nice post Kath!

Hannah says

Thanks for this post Kath! My husband is a grad student and we are in our first year of marriage in (very) small apartment, I could really relate to this and it gives me encouragement!

Caroline says

I’m usually mostly interested in your healthy eating and exercising posts (and more now on your exciting business venture!), but this is one of your best posts ever. For someone relatively young, you and Matt have a very mature approach to your lives and your future. This is the kind of thing that should be mandated for more young adults to learn about. I have an MBA and good basic understanding of finance, yet I still struggle with finding the time for budgeting in the midst of work and raising a small child. I also sent it to my mom, who is entering retirement and now has to manage at a reduced income. You have simplified what is an overwhelming topic for many people.Thanks!

Aaron says

I love, love, love this post!! I’m a big planner and am ALWAYS trying to get a better budget system. Mint.com is heaven!!

ered says

I just want to say I love love LOVE when you do posts like these–my husband and I are in a similar life-stage to you and Matt (I’m 28, within the next year we’ll be opening our first (acupuncture clinic) business, we save, we budget, and this morning I read that you are considering a little one to your own lives — I’m a supporter! My boy is 17 mos and he’s challenging but also the most wonderful thing. So anyway I love these posts. Hopefully I will be able to share something with you sometime as a give and take 🙂 And now, to update the billbook! Have a great morning!

Thealogian says

This is an EXTREMELY HELPFUL POST!!! Thank you for sharing your system. I’ve been thinking about doing a better job tracking my budget and savings (& debt pay-downs) via Mint.com (I think Jenette the “Half of Me” blogger also recommended it), but coupling that software with your tiered system seems like a great way to not only track, but VISUALIZE one’s financial reality. I have a bit of freelance work and adjunct teaching in addition to my jobby-job and I’ve really wanted to start prioritizing those incomes toward bigger life-goals and I think that some of these tools you’ve mentioned would be immensely helpful!

One thing I’d ad, would be a giving section to the general pie, even if you already do this through allowance or general bills, because it helps you prioritize how you integrate your personal philosophy into your spending. For example, every month I give X amount to my church and Y amount to a different charitable/social justice/environmental organization, like Sierra Club or Planned Parenthood, etc. Then I have my annual giving which happens once or twice a year to NPR or PBS (yes, I’m a very predictable Liberal). I’m also about to start a giving account with Kiva which is a micro-credit program for women in the developing world, where you make a loan of $50 and then so many months later, its paid back and you can redistribute it to another woman who is trying to better her life by saying buying a sewing machine or grow an orchard or buy bees. I’ve read somewhere that depending on your income, you should plan for a 1%-3% giving allowance, which seems way more manageable than the 10% “of your crops” biblical recommendation 🙂

Anyway back to your original post: BRAVA!

Jentree says

Love this post! I’ve been trying to figure out a new way to handle my budget. I started using Mint maybe 4 months ago or so, at your recommendation but have been trying to figure out a way to make it flow more easily. I like your idea of less spending categories.

Kate says

I’ll keep reading in a minute, but wanted to comment before I forget that your wedding dress is GORGEOUS! Holy cow. Not to veer into the realm of stalkerishness, but I keep a file on my computer of wedding-related pictures I like, and your dress just made it in! Okay, back to my regularly scheduled perusing…

KathEats says

🙂

Laura says

Love this series and that you included the finances in the home neat home section! 🙂 I followed your lead and did a post on my progress in my kitchen (http://www.wifemotherathlete.com/2011/03/minimalism-and-simplicity-kitchen.html) and will continue as I get the rest of the house completed. It’s been a long process, but it feels great. The budget is on the list … we are super duper savers, but that’s the only part of my budget that I’m organized w/ … the rest is a free for all! 🙂 Thanks for this!

Julia @ Brides Up North says

VERY USEFUL – downloading SPEND right now.

Been away for a while, so have loved catching up x

Charise says

This is helfpul! I tried using mint but got frustrated with the enormous number of categories that weren’t useful.

Lila says

Thank you so much for posting all of this and for the google doc! I’m trying to get started the Kerf way.. My only question is what do you do after 4 months? Do you start a new spreadsheet every 4 months??

KathEats says

I just copy the columns and keep moving them left – a new one each month

Lila says

Oh, haha. Thank you!

Krista (kristastes) says

This is one of my favorite posts of yours! I use a very similar format (in excel) to track my income/expenses/spending — I am a little bit more crazy with my categories but a spreadsheet with specific breakdown is SO helpful. Thanks for sharing, Kath 🙂

Leena says

OK, for your next Home Neat Home, can you please do a post on how you spend $250 a a month on groceries? Please? My jaw dropped to the floor because we spend $250 per trip to the grocery store, and we make 2 or 3 a month!

KathEats says

In the works….just in my head now but will be written in the coming weeks!

Kerry says

Kath, did you end up doing this post on grocery budgeting? I need help with that! I just searched a bit for it but couldn’t find it. Thank you so much for this post on budgeting, it’s a huge help to me!!! Kerry

KathEats says

I haven’t yet – I’m sorry!!!

Robin says

Wow! Glad to know I’m not the only nerd that has multiple expense tracking including good old excel! I love excel. My husband makes fun of me for using it so much but it is the best tool and so easy to modify for what you need at the moment. We currently use quicken but I might give mint a try since i really want an online management tool. 🙂

Erin says

Love this post! I recently began renting a house with my boyfriend and also just started to use mint! This was very helpful as we are trying to learn how to manage our money and save for the future! Thanks for the info!

Sammy says

It took me a while to convince my husband to start a household budget. It definitely requires some discipline and commitment (from all family members), but the results are worth all the effort. We by the way use a software called https://www.inexfinance.com/ to track expense and plan the budget, and I’m very satisfied.

Tara at Padded Tush Stats says

Kath,

Is there a particular reason for why you do the extra step of using Loot/Spend rather than just looking at the “Entertainment” budget in Mint?

KathEats says

Just to keep a second record for reconciliation. Actually, I don’t actually use the app anymore though! It got too tedious. But skipping the step of writing expenses down when they occurred did keep me from spending less. Its easier to overspend now that I am less accountable.

me says

I loved you budget!

Can you spare few words on how you actually stick to it?

For example, his, hers money? do you carry cash all month according to your budget or you make sure nor to go over when paying with cards.

I assume this can be tricky. Groceries is a very tricky one, at least for us as we LOVE great food and never go for cheap stuff..

Also, not sure if you are referring to any credit cards and how you manage these?

Many thanks!

Me

KathEats says

We each have our own checking accounts so we transfer the $ in there and then we keep track. I don’t always spend it all, so it accumulates. I also used to keep track using the Loot app on my phone – it’s a great way to make sure you don’t go over on any of these budgets.

JESSICA says

I am curious how you were able to remove the other spending categories of the budget on mint. I am trying on mint and haven’t found the solution. There are several sub categories they have preset.

KathEats says

You can’t remove them but you only use a small number of them to simplify. My Entertainment category is all fun stuff and nothing is subcatgoried

Kaci says

I love these budgeting ideas! Do you have any updates to the apps or programs you use?

Sarah says

Hi Kath! Is your budget process still the same? Or have you changed it? I’d love to see an update on this topic and my husband/I are thinking we should formalize a budget since we have a baby on the way. 🙂

KathEats says

It’s pretty similar to how it was then! Still use a spreadsheet and Mint.com

Sarah says

Thanks for the response!