This post is sponsored by YNAB.

Friends!! You know from two of my previous posts that I am a total YNAB (You Need A Budget) freak. Ever since trying out the budgeting program back in March of 2016, it has completely changed my life. I check in with my budget daily (sometimes more than once a day), and it has made me very intentional with my spending and savings goals. I honestly don’t know what I’d do without it! (Probably go back to complicated spreadsheets – shudder!) This is a product that I truly and wholeheartedly believe in, and I want you all to try it out!

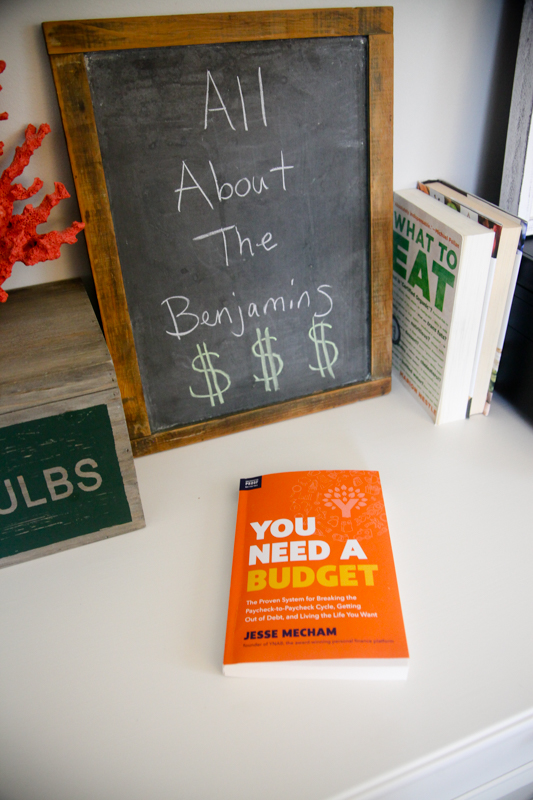

Imagine my squeal when I found out that the founder of YNAB, Jesse Mecham, has written a book that goes into detail on all the why, what, and how questions of budgeting. You Need A Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want is currently available for pre-order and comes out next week, on December 26. The YNAB team sent me an advance copy of the book to read and share on the blog.

Whether you’ve never budgeted or you’ve been using YNAB for years like me, this book will fire you up! It’s based upon YNAB’s four principles, but includes so much more too.

1) Give every dollar a job.

2) Embrace your true expenses.

3) Roll with the punches.

4) Age your money.

Mecham says “Think of a budget as a lifestyle-design blueprint.” Whether you are living paycheck to paycheck and not sure how you’ll pay for groceries, or if you just started a fancy new job and want to know you are reaching your long-term goals so you can have the confidence to buy the designer shoes you want now, YNAB’s program will work for you. It can help you get out of debt, save for a house, plan for retirement, and prepare for unexpected costs.

As I was reading the book and reflecting on my “lifestyle-design blueprint,” I started to realize how similar personal finance and healthy living are. Let me explain:

Budgeting and healthy living are a lifestyle, not a quick fix.

Just like you can’t go on a diet for one week, lose 5 pounds, and then go back to your old ways – budgeting isn’t something you can do for a month and then expect it to last. You have to be mindful and intentional about both your money and your health on a regular basis.

Flexibility is key.

As with health, there will be days when you feel like running 5 miles and days when you don’t have time to squeeze a workout in. There will be days when you eat green vegetables at every meal and days when you overeat. You have to be flexible and kind to yourself. Similarly, just as YNAB’s third rule states, you have to ‘roll with the punches’ when you overspend at Target or eat out a few too many times in one month. Taking money from less important categories to cover the overage is a normal part of budgeting.

There are many pillars to budgeting and health.

Diet, exercise, sleep, stress reduction – healthy living isn’t just one of these, it’s all of them. You can’t just do one and feel your best. Similarly, personal finance spans many categories: fixed expenses, variable needs, wants, true expenses, saving for the future, unexpected bills, etc. You can’t just budget in one of these categories, you need to be prepared for them all.

Knowledge is power.

The more you know about yourself, the better off you will be. Spending money and the health choices we make every day are both often emotional decisions. By taking a close look at our habits and reflecting upon them, we can best prepare ourselves for the future. Knowing what you spent on green juice (or sugary lattes) last month can help you tweak your budget for the next. Having a budget where you give every dollar a job actually gives you permission to spend your money on the things you want.

You don’t need to be perfect.

We are all going to eat cake for breakfast sometimes or drink too much on a holiday. No one is perfect. Similarly, we all overspend from time to time or impulse buy all.the.things. at Target (guilty!). Every step you take towards being intentional with your money (and your health) will snowball you into the right direction and good decisions will come more naturally in time. So, take the first step towards a healthier life – for your body and your wallet this year – and you will thank yourself later.

+++

I am giving away a free copy of the YNAB to one of you! Comment below with a budget tip you use (or perhaps one you want to implement in 2018!). The winner has been notified! Congrats to Debra.

Thanks to YNAB for sponsoring this post.

Charmaine Ng | Architecture & Lifestyle Blog says

I’m horrible when it comes to fitness (trying to improve!) so if finance really was like fitness for me… I shudder thinking about it, haha. Thank you for the tips on money management and budgeting! 🙂

Charmaine Ng | Architecture & Lifestyle Blog

http://charmainenyw.com

carol says

always keep an emergency fund

Katie says

No shame in a fresh start! I used to get overwhelmed if I skipped a few days (or weeks!) of looking at my budget- I love that YNAB offers a fresh start option when I get behind of logging transactions!

Alissa says

I love to use Mint. It’s great to keep everything organized!

Julia says

Love this post!! For 2018, the principle to give every dollar a job is one of my goals for 2018!

Vera says

Would love to learn about budgeting!!!

Alyssa says

Always invest in the future!

Cara Zimmer says

We started using Dave Ramseys Financial Peace University (which sounds a lot like YNAB!) and it has been LOIFE CHANGING for us! We have saved so much money and it’s nice to know where every penny is going. I would love to read this book!!

KathEats says

I LOVE Dave Ramsey’s stuff!! (Most of all because I like rules and the baby steps are great guidelines.) I think YNAB is better than Every Dollar because it can do more. I listen to Dave’s podcast all the time.

Katie says

Dave’s plan has changed our lives this year! We’ve paid off $57,000 of debt!

KathEats says

WOW – that’s amazing!!

Bethany says

Our family loves Dave Ramsey! Both my husband and I love the Every Dollar app and use it all the time. Keeps us afloat!

Sarah says

MY husband and I have an automatic transfer service up from our checking account to our savings account so we can make sure we are in fact saving the money we want to save.

Shana says

We make our credit card work for us. First, we use it for all of our expenses so we can see what we are spending all in one place (and seeing the lump sum is a nice reality check!). Second, we pay it off every month. Our rule is that if we we need to finance it, we can’t afford it. Lastly, we cash in our rewards points and put it directly in savings (sometimes that $150 dollars at a time!).

Linda McCorkle says

If you are going to use a credit card always pay off your credit card each month.

Renee Van Reed says

Use cash instead of plastic! Keeps you more aware of the money going out.

Melissa says

I’m big on couponing! I’m always clipping the coupons that come in the weekend newspaper, searching for coupons online and joining store loyalty programs where they allow me to digitally “clip” coupons and load them directly to my card.

Molly says

I started implementing the snowball method to pay off debt and want to be more aggressive with this in 2018.

JennieM says

I would like to make savings for a vacation a “normal” part of our budgeting system. We usually do a big spring break vacation every 2 or 3 years and start saving for it 1 year in advance – so it is a cash vacation. I would like to do this every year and get into that “savings” mode as a normal practice.

Misty says

I try to stick to a budget for eating out…so my rule is to only eat out once a week…sometimes it works! 😉

Emily says

Instead of going out to eat, we spend time making an elaborate meal at home. It’s healthier, cheaper, and we get more leftovers!

Katie says

My biggest budgeting tip is to give every dollar a name. If you don’t know where your money is going, it will disappear!

Jessica says

I like the rule of waiting 24 hours before buying something. I think we underestimate how much emotions can play into spending money, and its a good idea to just give it a day and let yourself decide if you REALLY need it or not.

Thanks so much for the giveaway.

Stephanie says

I have wanted to start a budget ever since my first child was born 14 years ago. I have attempted unsuccessfully many times, but after reading your description of this book, I am hoping to give it another whirl. Seems important to do this for SO many reasons. Thanks!

KathEats says

You will love the YNAB software!

Megan King says

Think critically before making an unexpected purchase and don’t spend what you don’t currently have!

Jessica Loeffler says

Only allowing ourselves one grocery trip a week. This means meal planning but might mean some scrounging through the pantry and freezer if we don’t do a good jo.

Caroline says

I am committed to making a budget in 2018! My boyfriend and I moved in together and I started new job this year and our goal is to save up for a house!

Emily says

This is bad…but my budgeting tip/goal for 2018 is to actually make a budget. Lol.

KathEats says

Haha!

Anna says

Same here!

Kristen says

One of the best budget bits of advice I received when I was younger was to not increase your spending/lifestyle with job promotions and raises. This has served me well.

Kara Odell says

My husband and I have one joint account for all our joint expenses and then we each have a separate discretionary account for our fun money. We get a set amount to spend how we choose. I choose to spend more on a CrossFit membership and he goes to a cheaper gym. He spends more on nice whiskey and I’m happy to drink cheap wine from TJ’s. This way we both get what we want within a limit without feeling guilty.

Margie says

Save for retirement, starting as young as possible.

Jessica says

This. Also, take advantage of any company match offered for your 401(k) or other savings plan.

Sue says

No one was ever disappointed that they saved money.

Jen says

I’ve been using YNAB for a year and it really is an amazing tool!! I would love to read this book. Grocery shopping is my biggest temptation and splurge, so I will budget a certain amount and then give myself that much cash for the month. I take what I need for that week’s shopping, and if I run out at the end of the month, its freezer/pantry food until the next month! I’ve made a game of stretching it with apps like Ibotta and by coupon clipping.

KathEats says

Groceries are my biggest struggle too!

Rachel Liebov says

I always follow the rule to pay myself first so put a portion of my paycheck into my 401K and savings accounts automatically.

Brianna says

I would love to learn more about budgeting!

Grace F says

My number 1 tip is courtesy of my dad: always pay off credit cards

Melanie says

I try to not go out for meals more than twice a week.. which is very hard living in NYC! My husband and I keep saying we need to actually develop a budget, this is definitely motivating!

Lindsey says

I have set up automatic monthly deductions to a personal Roth IRA account so that I reach the allowed amount by the end of the year.

Morgan Culbertson says

My husband and I use YNAB as well and it has been a lifesaver! My budgeting tip is to have a quarterly meeting with your partner or whoever you budget with to pull your numbers, dump them in a spreadsheet and see where you are. My husband and I do this and its a great way to stay on track and see your successes. We put it on our calendars so we can’t ignore the day and I always buy a bottle of cheap wine from Trader Joe’s to share as we budget.

Liz says

Using cash for easy to overspend categories (like going out to eat) can be helpful. If you budget $200 for the month, then pull that much from the ATM and once it’s gone you don’t eat out anymore! It really keeps me mindful.

Erin m. says

I’m changing my 401k to a Roth 401k

Mary says

Hi Kath – I’d love to know more about how you have your expenses categorized in YNAB. I started a few months ago but now find myself wondering if my coffee (or wine or Seamless) budget is a True Expense or a Just for Fun? On one hand, I realize these aren’t necessities, but they also are facts of my life right now (and I’m ok with that!). Just curious how you think about these types of things in the context of budgeting. Thanks!

KathEats says

Here’s my budget list:

Fun Savings (like vacations, new big purchases)

Retirement (IRAs)

Investments

Emergency Fund

(^I put those at the top to inspire me!)

Spending Money (totally discretional)

Dining Out

Beauty/Spa

Mazen

Gifts

(^All wants not needs. I would put a big case of wine under Spending Money)

Mortgage

Gas/water

Electric

Internet/cable

Alarm system

Mazen school

Health insurance

Groceries (coffee is a need not a want and goes in here, so does a single bottle of wine)

House cleaning

Gas

Household (TP, paper towels, batteries, etc)

(^All recurring monthly expenses)

Gus

Blog recurring expenses

Gym membership (we pay this once a year for a discount)

Auto tax

Life insurance

Other insurance (auto, liability)

Summer camp

Subscriptions

(^all true expense categories that don’t go to 0 each month)

Blog reserves (extra blog expenses)

Home + Yard (have a mini savings here)

Medical (have our deductible here)

Auto (have $1000 here for repairs, oil changes)

Travel (I move money here from fun savings before a trip)

Life unexpected (big purchases get spent out of here)

(^all reserves that get replenished if used or filled when needed)

TAXES

(^UGH)

That’s it!

Sara says

I am so thankful for your list! I have tried YNAB multiple times but keep failing and I don’t know why. I think I haven’t fully grasped the HOW on it and your list helps me see how other people categorize their expenses. Thank you!

KathEats says

🙂

Andrea says

Great post, Kath! Especially with the new year approaching. The practice that has helped me the most is to set up a weekly “money meeting” with myself. It’s a chance to check in and make sure I’m not neglecting anything (bills, retirement contributions, etc.) but more importantly it’s an exciting time to plan some action steps that support my dreams for the future. Keeping those goals in mind makes it easier to say “no” to the kind of mindless spending that doesn’t enhance my life or move me any closer to what I truly value.

Tonya says

I want to start using cash more than my debit card. Even if I budget X amount of dollars for the weekend, it’s so easy to blindly swipe away and overspend. If I use cash I can SEE the dollars as they diminish and put on the brakes. (Truth–I was gonna glance through this post pretty quickly, but then my inner voice stopped me and said WAIT! you NEED this info! You literally need a budget! Hahaha)

KathEats says

Hahaha!!

Laura W. says

I want to invest more!

Grace says

I want to budget in more “true expenses”- things like Christmas presents, doctors visits, and car maintenance!

Laura Swanson says

I save soooo much money by not eating out lunch during the work week. I bring my lunch every day and not only is it cheaper, it is healthier! You can easily save $50+/week by not eating out. I’d love to try YNAB out!

Amy Longwell says

more cash so I can SEE my money rather than swipe it away 🙂

Paige says

I’ve been using cash instead of credit or debit cards, which has been helpful in understanding *exactly* how much I’m spending. The act of giving up cash is more impactful for me than the swipe of a card!

Brigid says

My father always said “Pay yourself first”. By this he meant to save first and make your life work with what you have left. I wish I would have followed this advice earlier in my career/life! One of my goals for the new year is to work on a budget and to really be more mindful of spending, eating, time usage, etc. Sometimes I have no idea where our money goes! I would love to read this book. We have three kids, the oldest of which is going to college in less than 2 years and the cost scares me to death!

Kathy Kern says

I’d like to retire in 4 years and need to find a way to put more money away for that.

Claire Cannon says

We use an envelope system and use mostly cash. It makes it easy to track every penny.

Kim says

Would love to start budgeting. My husband and I are self-employed so I have always been overwhelmed to know where and how to begin budgeting when your income is not the same each month. It’s so not an excuse, though!

KathEats says

Living on last months income and putting windfall months into future months will be life changing for irregular incomes!

Katherine says

Meal planning makes the biggest difference in our budget. Then I know what I need to get from the market and am spending weekly on groceries. I do a monthly big shop at Costco and then fill in weekly as needed. It keeps me on track. Without meal planning, we would eat out a lot more!

Lacey says

I currently use everydollar but am excited to read this book and check out the budgeting software! I do like everydollar but there are a few improvements I wish they would make and maybe YNAB already has those. In 2018 I want to work on my grocery budget… it’s by far my hardest category to keep under control. I think meal planning will help.

Liz says

I save all the spare change we get in a large piggy bank. Every year we have about $200 in change. We use this money to do a special family activity.

Stephanie says

I’ve been trying for years to create a budget system that works for us. I’m hoping that these strategies will help me stick to it!

KathEats says

I PROMISE YNAB will be the best one you’ve tried!

Catherine says

My favorite finance tip is to direct deposit into my savings account and a checking account I don’t regularly use, that way I don’t see it in my checking account and think I can spend it. Works like a charm!

Linda @ the Fitty says

Some parallels I see here, thanks for sharing! Especially when it comes to flexibility, life gets in the way so anything that goes for Fitness, also goes for money in the way that you have to cater to circumstances.

Maggie says

I think using cash is one of the best budgeting tools my husband and I have used in the past. We have gotten away from it and are having a harder time saving. I look at our bank accounts and Mint all the time but he rarely does – the visual of cash is really effective for him so I think we need to get back to it. Have tried a free trial of YNAB but couldn’t quite figure it out – would love to try it again cause I’ve heard such great things

KathEats says

It takes about a month to get the hang of it, and if you don’t have enough funds in your account to cover one month, you’ll need to spend a few months building up a buffer, but once that is going, it’s SO fun!

Alana says

My number one budget tip is pay yourself first! Decide what you need to allocate to retirement and then divvy up the rest of the budget. If that means making some major life changes (downsizing, etc) then that is what needs to happen. It can be a hard practice to put in place but will be so worth it in the end.

Dawnelle Breum says

Oh my gosh. I have read your blog for years and this is the most exciting giveaway to me! I am recently single and just started using YNAB. Life changing for sure! Thanks for giveaway- crossing my fingers.

KathEats says

Yay!

Erin says

We use change jar – where our bank automatically rounds up our debit transactions and deposits them into our savings account.

Jenn says

I currently use the Every Dollar app, so I”d be interested to see the difference in the two software programs. One budgeting tip I use is to always set aside a little money in my Miscellaneous category for all those little things one might forget or if something unexpected pops up!

Laura Holmes says

Would love to read that book! My budget tip is to shop at Aldi! I always shop at Aldi first and then go to another grocery store to buy anything that Aldi did not have. Aldi’s prices are amazing and it is worth that extra bit of time that it takes to go to an additional grocery store.

Kim says

I need basic information on how to start budgeting.

Kelly says

Every month I automatically move 20% of my paycheck (after taxes and deductions) into my savings account.If the money doesn’t show in my checking, I’m far less likely to spend it! Thanks for the great giveaway, I’d be interested to read this book!

Robin says

There is a phrase that has really stuck with me over the years:

“Two things determine your (financial) success in life:

1. The way you manage when you have nothing

2. The way you behave when you have everything”

When my husband and I got married almost 20 years ago, our finances were so complicated. Within a 3-month period, we got married (DIY-ing almost everything ourselves), bought a house, and he opened his own business. There were business loans, student loans, a car loan, etc. etc. He was determined he would only take a paycheck himself, if there was enough to pay his employees and “keep the lights on” at the office each month. We got used to living on my income (and ramen noddles), so when he finally started taking a paycheck we put it directly towards paying off loans, IRA/401k, etc. We never saw the money, so we got used to living without it. To this day, we rarely go out to eat unless we use a gift card we’ve received for a birthday or coupons. We still live like we have “nothing” but that means we have the comfort of knowing our emergency funds, retirement, college saving plans, etc. are squared away… which is peace of mind (“everything”).

Amanda says

For purchases, I have always thought of money in terms of my time… like x dollars equals y hours of working. My time is valuable to me, so it makes it easier to walk away from things I don’t truly want. My goal for 2018 (I should say my husband’s and I) is to learn more about investing. I want the money we invest to work hard for us and while the basic 401k is nice it is not enough for our future goals.

Beth says

Budget tip: Pay off your credit card on time every month, no matter what. – my Dad

CaitlinHTP says

Oooh pick me 🙂 My budget tip is to have savigns automatically transferred out so you don’t have to manually do it.

Sarah F says

I love so- as a CPA I am all about promoting financial literacy! It’s scary how little we learn about finances before we’re expected to be an adult!

My biggest thing I do is set a realistic budget! At the start of every month, I look at one-off costs that I know I’m going to incur (like a haircut or presents I need to buy), and I adjust other expenses for that month. Then I don’t overspend on eating out during the same month that I’m spending more on shopping for presents.

Kelli Jamison says

I feel like personal finance should be a required class in high school (and maybe it is, but wasn’t in mine). As I’ve gotten older I’ve realized that it really is a skill you have to learn. So, 2018 is my year to learn and earn!!

amy says

My husband and I are both very frugal, but my goal for 2018 is to actually create a budget so we can make a plan on how to save and execute for an eventual kitchen reno project.

Anna says

I need to get better at budgeting. Last year I started using Mint, but abandoned it halfway through the year. I like seeing all my accounts in one spot – checking, savings, retirement, the kids’ 529 savings, etc. But I overspend at Target, mostly because I don’t know how to adequately budget for household stuff like TP, detergent, etc. Any tips on that?

KathEats says

Mint is more reflective than proactive. I know they have a budget section, but I found it to be very weak when I used it years ago. What I love about YNAB is you are telling your dollars what to do BEFORE you spend them, and the app is super easy to use and check when you are hitting the aisles at Target. I still use Mint for the reason you mentioned – to see an overall snapshot of my whole finance picture, but that’s just about all it’s good for! (I searching years back for transactions).

Yana says

LOVE YNAB. It has changed my life. Would love the book

Emily S says

We automate our savings and bill payments each month. We actually need to track our spending in 2018 though.

Megan says

While we are fairly frugal and don’t live beyond our means, I know my fiance and I could save more if we tightened things up and wrote more down. We’re getting married in the spring and are hoping to build a house on some property we bought a few years ago. My goal for next year is to sit down and crunch the numbers as to how we can start construction.

My best budget tips are a combination of plan your meals and grocery shopping trips, cook at home, and pack your lunches rather than going out to eat lunch at work. I save so much money this way, and we eat much more healthily too!

Nicole says

My favorite budgeting tip is checking in often with my expenditures to evaluate where I am in any given month. It’s very helpful!

sarah says

love YNAB! I just started using it this year and its awesome… the only budget app i have ever stuck to! I want to build up more savings in 2018

Katie says

My intention for the NY in terms of budgeting is to set aside a certain amount each month for clothing/personal items. Some months I spend way too much on clothes and workout gear, so I want to be more thoughtful when it comes to purchases like these.

Sarah says

I need to start budgeting in 2018. I keep detailed recorded, but never budgeted.

Aimee says

My husband and I are I dire need of a financial plan,as we haven’t one at all! Would love the book as it sounds like a great place to start!

Debra Powell says

Its rather embarrassing but we basically live paycheck to paycheck with 4 kids who want to be active in everything from gymnastics and dance to going to the movies with friends. Its almost impossible for us to save a dollar. We would love to be more intentional with our money and this could help us start. So pick me!!

Ashley says

I try to budget the best way I can. I really don’t feel like a have a true sense of direction though. Might be changing my job nod will have to pay rent. That is my biggest fear! Would love a copy to get a better understanding

Rebecca says

Is it bad that I just want to *gasp* have a budget? I an nearly 30 and married, so this is long overdue. It’s a big goal for 2018!

BK says

We set aside a weekly budget for groceries and get cash for it. If the cash is gone, oh well – we know we need to cook with what we have.

Natalie says

I’ve started automatic withdrawals from my regular bank account to a tax-free savings account, and am investing in an RSP. Both happen before I will really be able to notice what I’m missing from my pay!

Mary Pennington says

This sounds like a great read! One of my best budget tips as a married gal is for each of us to have a “slush fund”. We each get a set amount of money for our own wants without criticism from the other person. Maybe it’s a couple meals out with friends, maybe it’s a manicure, maybe it’s beers with the guys. We just get to spend it how we want it! It makes it easier to stick to our budget in other areas.

KathEats says

I totally agree on this one!

Kelly says

Favorite budgeting tip? Don’t even let yourself TOUCH your money… set automatic payments from your paycheck into 401ks or savings accounts so the money gets into savings before you can get at it.

Michelle Kornfeld says

I want to start using the cash only rule in 2018. I use my debt card for everything & I don’t realize how quickly the little things add up.

Michelle Reiter says

I want to start using cash only for my husbands and I’s ‘extra’ expenses every month. I think that would cut down drastically on our spending because every little thing adds up.

Elisabeth Null says

I have two – for me, the snowball method of paying off debt works best and I also always have a good sized emergency fund in the bank.

Stephanie Nullmeyer says

1 way I save on our grocery budget is to always meal plan before shopping. We also don’t eat out much (4 kids!), so that helps.

Natasha says

Pretty much always shop at second hand stores plus people tend to give me hand me downs. I make sure to hit the bank every two weeks to deposit into my savings and just keep enough cash on hand.

Jo says

Honestly, I just want a budget…which may require me taking over the finances. Besides that, I want to work on Dave Ramsey’s snowball method and pay my smallest debt off and work up to the largest debt.

Mallory Driggers says

I was using YNAB but after a divorce I was barely able to make ends meet, and it was hard to face that reality! So I just spent very little and prayed for $$ left at the end of the month. Not a method I recommend! Now I just got a new job and I’m excited to budget again. Will definitely be looking into YNAB to use as an independent woman!

KathEats says

I started using it right around when I got divorced (maybe a little before) and it was me having 100% control over ALL of the money decisions that got me the most fired up. Even when times were tighter, I knew I was the only one making the decisions, so it was easier than budgeting had been in the past. Give it another go. (And best of luck to you as an independent woman!)

Mallory Driggers says

Thanks for sharing that! I think I will start 2018 reminding myself that I make ALL the money decisions so they should always be good ones! (+the splurge here or there, all about that balance!) Always enjoy reading your blog, Kath.

Katie Meier says

I write down every single purchase I make each month. Knowing I have to record it makes me think twice whenever I’m on the fence about purchasing something I don’t absolutely **need**

Barbara says

Spend less than you earn! Seems simple, but I track my income and expenses so,that I know where I am.

Kelly Franks says

I’m horrible at finances. I love to buy things. My love language is gift giving. ?? I will say that giving every dollar a name and account for it is the best advice I’ve been given!!

Liz says

My best budget tip is to Look up Dave Ramsey.

KathEats says

Haha! Love him.

Laura says

We are savers who live below our means to be able to give generously, but I’m not familiar with YNAB. I would love freedom from my crazy excel spreadsheets and calculator! One tip that works well for my family though (and it sounds like he addresses this) is to look at the expenses that come annually or semi-annually and factor them in monthly so we know the money is in the account when it’s time to pay the bill (car registration, kids dental plan, private school tuition, etc…). It makes us feel like we have less each month, but we know we won’t have to move money around to pay those bigger expenses. I love that you’re blogging about this, Kath! I think so many people feel like budgeting is just too hard or too much trouble or too confining, but there is really so much freedom in it!

KathEats says

Yes that’s rule #2 for YNAB – be mindful of true expenses. Those expenses were the number one eye opener for me when I started seriously budgeting too.

Melissa says

2 of my budgeting tips are:

shower at the gym to save electricity

free coffee at work

I need this book!

Alisha says

TBH I just need a budget period. I just quit my job and went back to medical school, but living off of loans is SO different than every other week paychecks. I need to account for the emergencies without running out of cash by the end!

Christie says

I make sure part of my paycheck goes directly into my savings account and I don’t touch that money!

Cate says

My monthly retirement account contribution is electronically deposited before the remainder is deposited into my bank account. I have also accumulated a healthy emergency fund. But I need to better account for my smaller expenses, and I would love to share what I learn with my mom, who is recently divorced and will really need to budget carefully moving forward.

Leigh says

This year has definitely been full of unexpected financial hits, and I feel guilty about spending anything for fun. So unlike all of the responsible people here, I’d like to budget so that I can do a few things for myself without worry!

Kristin B says

I wait 3 weeks before making clothing purchases. This cuts down on impulse shopping and gives me time to process whether or not I really “can’t live without it.” 🙂

Rebecca says

I LOVE You Need A Budget!! The best tip I’ve stuck to is to actually “work your budget.” In the past it was easy to ignore apps/tools like Mint.com because I’d put in projections for monthly expenses and then, when things went awry, would jump ship instead of making adjustments…and I never ended up meeting my financial goals. Things vary and plans change, but you have to work your budget so that it can work for you!

gizella says

the one that really works, since we are a family of four on one salary and get paid once a month, is taking money out and putting it in an envelope if we need to use it later. That way, I won’t spend away something accidentally and then have to use the credit card. We aren’t 100% with this, but it works most f the time.

Renee says

Meal planning is one of the ways we save the most money, I think. But I would love to learn more about budgeting, esp now that I started my own business as a new dietitian and would like to move into that full-time. I have been curious about YNAB for a while now after hearing about it from you, but haven’t had time to really take a look yet (grad school!). Need to pay down that second-degree school/internship debt! Yikes!

Cathy says

We have been using YNAB faithfully for five years and I still say “I love YNAB” almost every time I use it. I have been thinking a lot lately about how healthy living and budgeting are so similar, especially in regards to how important it is to be flexible. I loved that your post put into words exactly what I’ve been thinking lately.

Tiffany V says

In 2018 I really just want to make a realistic budget. I haven’t actually made one before, so clearly this book would be helpful.

Stephanie says

We pull out cash at each pay period and put into different envelopes for each category (gas, food and toiletries, discretionary). It has helped so much to have to hand over cash for every purchase!

Anne Weber-Falk says

We need to get on this bandwagon. We don’t have a budget system in place. Most months we just hope for the best. We are retired now and get paid once a month. We have just started paying every bill the day we get our check. What is left goes into a second account. From that we buy groceries and fuel. Any money that is left at the end of the month stays there. Then we start all over with the next check.

Grace says

This is not at all novel, but I set up a bunch of sub-savings account for monthly expenses like child care and students loans, and less regular things like “travel,” etc., in addition to our regular savings, and I set up automatic transfers on payday to move set amounts over to all these accounts. Some accounts we draw from monthly for fixed expenses, like the child care and the mortgage. Others, like the Christmas account, we draw from (i.e., empty) once a year. This method helps us avoid big hits like car insurance every six months by saving a little at a time from every paycheck, and it encourages us to budget for random, fun stuff within whatever is left over in our checking account after all the transfers because I know everything else is earmarked for something else. Still, sometimes we borrow from our savings but not often!

Carrie says

My #1 tip is spreading out periodic expenses throughout the year so the expense is all accounted for when it comes time for payment.

Molly Koczarski says

my biggest budget tip is to always invest for the future! 🙂

Rosie says

Not sure if its a budget tip but I do make sure to max out my 401k and 457 plans-pay myself first!

Kim says

Great post Kath ! I have found in the past sticking to my grocery budget has been an area where I tend to go over my budget for the month – a couple of tips that have really helped me stay on track are 1). Shop my pantry – freezer BEFORE I head to the grocery store ( meal planning ) and 2). A couple of times a month I order my groceries online at my local Hannaford Grocery store – very simple – wonderful service and they do choose great items for you ! It eliminates the impulse purchases! And you are literally in the store for about 10 minutes !

Hannah says

I shop second hand for almost all of my clothes. Not only is it cheaper, it’s better for the environment and you’re less tempted to buy extra stuff that you see at the mall or fancier stores. I’ve been shopping more at regular stores for Christmas and it’s so much more tempting!

I keep a budget spreadsheet and I check it regularly with a calculator. But now that I’m a mom, I have less free time to spend doing that!

kelly says

I need help understanding how to budget for things that are not monthly. And what category to put all the little things!

Kristin says

Oh yay! We are such budget nerds over here. We’ve followed Dave Ramsey’s plan from Total Money Makeover for years and love it. One of the biggest things we do that my dad taught me growing up is an envelope system for big lump sum expenditures. For example, we have an HOA Dues envelope, a Christmas envelope, and vacation envelope, etc. We contribute cash to each every month so it doesn’t sting as bad when those big expenses come.

Nelle says

Would love to win a copy of that book!

Currently I use the calculating formulas within the Goodle Sheets. All incoming money goes to the top and static expenses like savings, rent, utilities are copied and pasted from month to month. There is a cell for other expenses that are also irregular. Because I’m a teacher, I get paid at the end of the month and plan out the entire month on the 1st. All bills are paid then as well so that what remains is for discretion, groceries, and fuel. Takes a lot of guesswork and ensures no bill is forgotten!

Gretchen Caldwell says

I love YNAB and can’t wait to check out the book. I’m a financial planner and my #1 recommendation to folks struggling with budgeting is to embrace your real expenses. Almost everyone brings in a budget that is just there bills and groceries. Your budget needs to account for all of the ,ones you spend each month, that is the only way to know why you might be struggling with spending. Thanks for a great article Kath!

LisaF says

I’m starting 2018 debt-free (WOOT!) and want to keep it that way & build up my savings — need this book!

My tip: I leave stuff in my Amazon (or other online site!) cart overnight to see if I really, truly need it before I hit that purchase button!

Maggie says

I’d love to learn more about investing and review smart budgeting tips!

Jessica says

Honestly, I can’t believe how many people have envelopes with large amounts of cash just sitting around their house. Although interest earned isn’t much, it’s still more than none! My tip is to put your savings in a savings account, Roth, or other investment vehicle like stocks to let your money work for you.

Check out this information on compound interest to see why –

https://www.bankrate.com/banking/savings/compound-interest-calculator-tracks-saving/

Bex Penn says

The extent of my budgeting is looking for a coupon code before I order something online! Oop! I definitely need to get it together!

KathEats says

Haha!

Elizabeth says

I work on commission so my income from month to month can be very inconsistent. I try to minimize my recurring monthly expenses and live below my means. I also try to be intentional with my purchases and try to only buy things I know I will treasure for a long time. As my kids have gotten older and need less “stuff,” as a family, we have embraced a sort of minimalism to limit the amount of clutter and disposable items around the house. It’s a work in progress . . . .

Alexandria Hardy says

I need to be better about budgeting for unexpected expenses in 2018. Super interested in YNAB; thanks for sharing!

Sarah H says

I keep track of everything using Mint. It makes me life so much easier! But I don’t necessarily put every dollar to a task, so I’d love to learn more from this book!

Amy says

I love these suggestions!!

My number one is to pay yourself first — Roth IRA, 401K, whatever. Compound interest is amazing, and you want to make sure that your future is as stable as possible.

My second tip is to be generous and to budget giving to others. It’s fun to be able to bless others, and you’re ultimately blessed by giving as well. 🙂

Michele says

Oh…this is tough and the post actually makes me want to cry. Odd reaction huh?

My husband is self-employed; his shop (which he did not own, only rented) along with another business was 100% destroyed in a fire which started in my husband’s shop 03/03/17… https://www.youcaring.com/jimgreenwoodsfamily-771178

You can see from the youcaring website, we were blessed with a significant amount of money but due to other conditions you’ll see below (bankruptcy); NONE of those funds could be used to rebuild the business or our lives. The ONLY protected asset where we live is your home, so we paid it off – BLESSING – but still had $ left over so we had to figure out what to do.

I won’t go in to all the details but a few key pieces: we did not have insurance; in fact, we couldn’t GET the space insured as it was not ADA compatible, no sprinklers, building over 100 years old; we had hundreds of thousands of dollars of CUSTOMERS equipment in the shop; hubby was forced to file bankruptcy, I did not.

Such a long story; but truly – figuring out HOW to recover, how to move forward, how to pay for college (we have 2 in college currently), how to pay our attorney as well as the bankruptcy trustee’s attorney (separate person), how to break the cycle of living – kind of paycheck to paycheck; it’s a bit different when self-employed, just b/c you invoice people, doesn’t mean they pay you timely, is so critical for us right now.

YOU NEVER IMAGINE YOURSELF IN THIS SITUATION!

So yes, this brings up so many emotions and reminds me not to give up, to keep pushing ahead…one step at a time and look for sources that will HELP us rebuild and get back on track! 😀

Thank for the chance to win!

KathEats says

Oh Michele my heart breaks for your family! This must have been so awful. I wish you guys the best <3

Michele says

Thanks Kathy; really no words for what we are STILL experiencing. Did you know when you file BK you have to buy back your vehicles – EVEN WHEN THEY ARE ALREADY PAID OFF? Yep; tis true. We are still going through the BK and will be for another 4-6 months most likely. Thank you for the wishes; WE CAN USE THEM.

#survivors

#wecandohardthings

Becca says

Budgeting is definitely not my strong point, and it is actually something I want to work on this coming year. My one tip for budgeting is to sit down at least once a month, if not every other week to take a look at your budget and finances. If you have a significant other, include them in this as well. Communication about finances is key!

paige o says

we need to start budgeting in the new year, so far we cut out expensive coffee drinks aka make coffee at home and alcohol during the week and that helps a bit!

Jenny says

Great post! Some of our budget tips are meal planning so we do not waste any food we buy, sticking to only buying things on the list at the store so we avoid splurges, bringing our own lunches to work, and trying to do as many house projects/repairs as we can ourselves so we don’t have to hire others to do it. Thanks for doing the giveaway!

Katy says

If you can afford it and it saves your sanity, oftentimes it is worth the little added expense.

Ella says

My husband is a financial analyst and I’m a dietitian and we find A LOT of overlap in the ways that we end up helping people. He does a lot of volunteer financial counseling through our church and just out of the kindness of his heart to friends/family, and we’ve found over the years that we end up preaching a lot of the same things… short- and long-term planning ahead, moderation, making room for splurges, making healthy discipline a part of your life…. and the overall well-being that results from having healthy finances/healthy eating can’t be overstated!

KathEats says

Love it!

Sarah C says

Ugh, I have no budgeting tip, but as a single mom about to get a large raise when I graduate in a few months, I definitely need to learn how. I think budgeting, finances, taxes and banking should be a mandatory class in highschool that lasts at least a semester if not a year.

Kersten says

Amen Sista…

Having gone through a divorce recently with children has been a life changer! I want to feel “normal” or real for the first time in my adult life. I’m kinda afaraid to truly look at things that have been turned upside down. I want to get something right for once!?!?

Alicia says

I’m starting an accelerated Masters in Nursing program next month and will be on a very tight student budget. This book could be a tremendous help for me adjusting to that life after working full-time for so many years.

Kristen says

My tips are to use a Flexible Spending Account for medical expenses and to slowly increase your monthly percentage of savings for retirement.

Jae says

If you are single you should save at least (3) months of expenses prior to attacking your debts. (If you lose your job you don’t have a spouses income on which to depend)

When going on interviews you exude confident, not desperation, because you have money in the bank!

Nicole @ Bento Momentos says

I keep all of my receipts from the year in a little accordion folder. Makes me more mindful and if I need to return something, I know exactly where the receipt is!

Cindy says

My goal for 2018 is actually just to make a budget. We have been married for 15 years and have 3 kids and always put some money away for savings but we really struggle with the day to day spending on silly stuff. I would love to have this book and a fresh start.

Lauren says

The best thing I do is pay myself first–I have money automatically withdrawn into other savings accounts. If I don’t see it, I don’t miss it. However, I’d love to get better at day to day budgeting for groceries, Target, etc–the little things that add up!

Renee says

First off this is an awesome informative post. Thanks for sharing and for the giveaway

Now I know nothing about budgeting hints why in love this post so much. I know every bit we try to save ends up going to something else and then we start over. I also know that eating out and getting coffee everyday adds up. So I guess that’s my tip. Figure out how much it costs weekly to go to Starbucks or eat out, and then add that into your savings. But you don’t have to stop eating out just limit it to 1-2 times a week.

Jenn says

I’ve been thinking about signing up for YNAB. I’ve heard great things on it.

Kelsey says

The best financial advice I’ve ever received was to start saving for retirement ASAP. I started at my first job right out of college at 22 and now at 30, I can’t believe how much it has grown. I have it taken directly out of my paycheck so I don’t even miss the money.

Meghan says

Have been using YNAB since 2015, and I whole-heartedly agree with you. It is life-changing. Whenever I tell people about it, though, they look at me like I have 3 heads because who gets so excited over budgeting? YNAbers, that’s who!